public:cb_mirror:co_document_library_case_for_series_part_4_pdf_files_28756

To view this on the COS website, click here co-document-library-case-for-series-part-4

To download the pdf file from the COS website, click here 4._Case_for_Amending_U.S._Constitution_(Balanced_Budget%%__%%August_30%%__%%2024)-merged.pdf

CO Document Library-Case for Series Part 4

Attachment: 4672/4.CaseforAmendingU.S.Constitution(BalancedBudget%%%%August30__2024)-merged.pdf

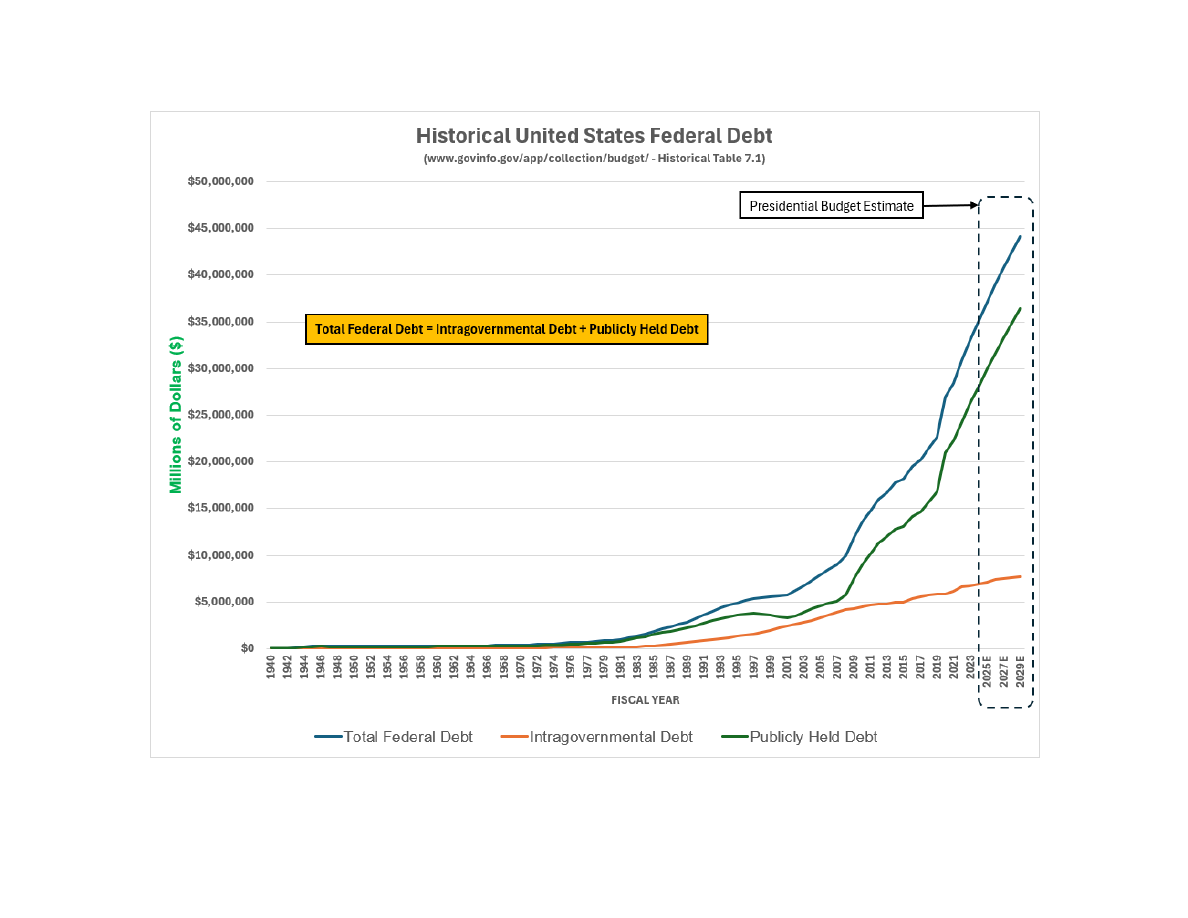

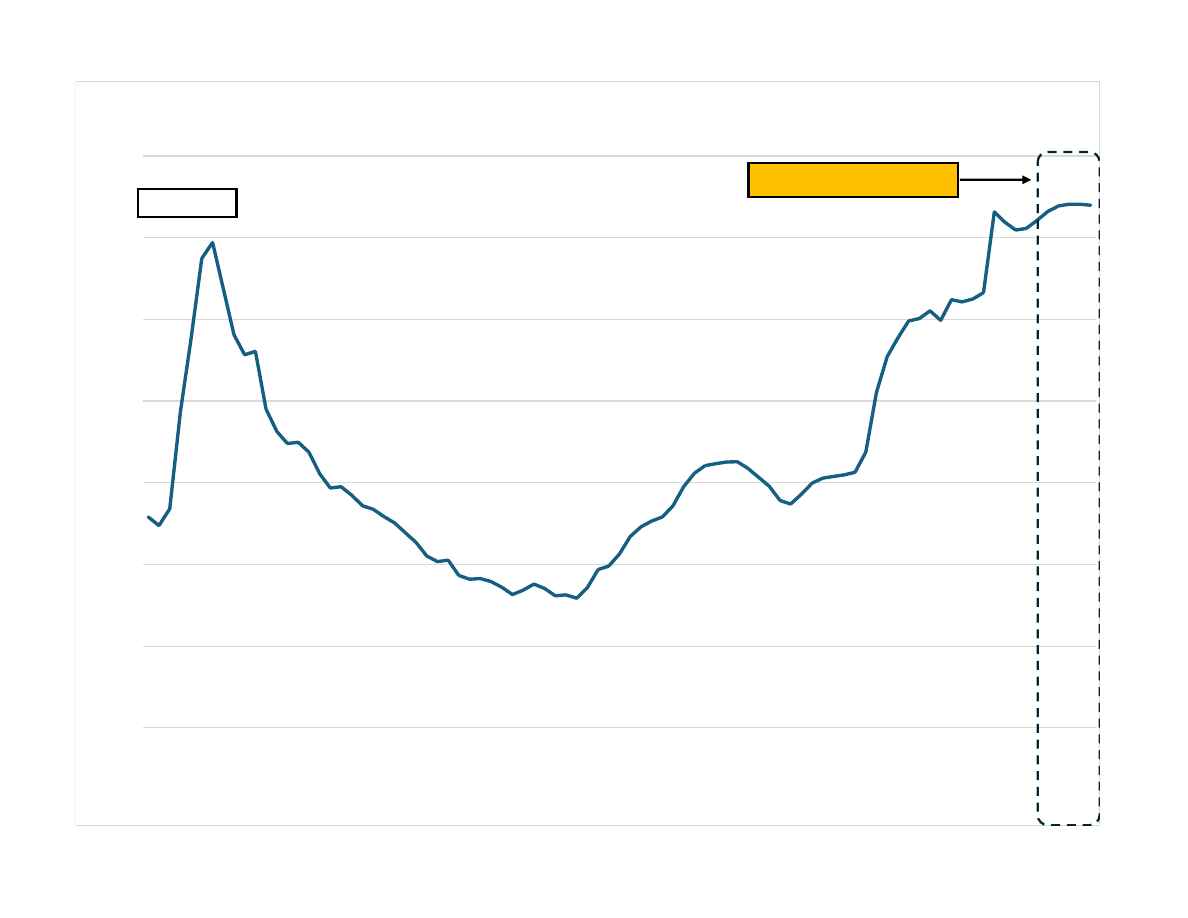

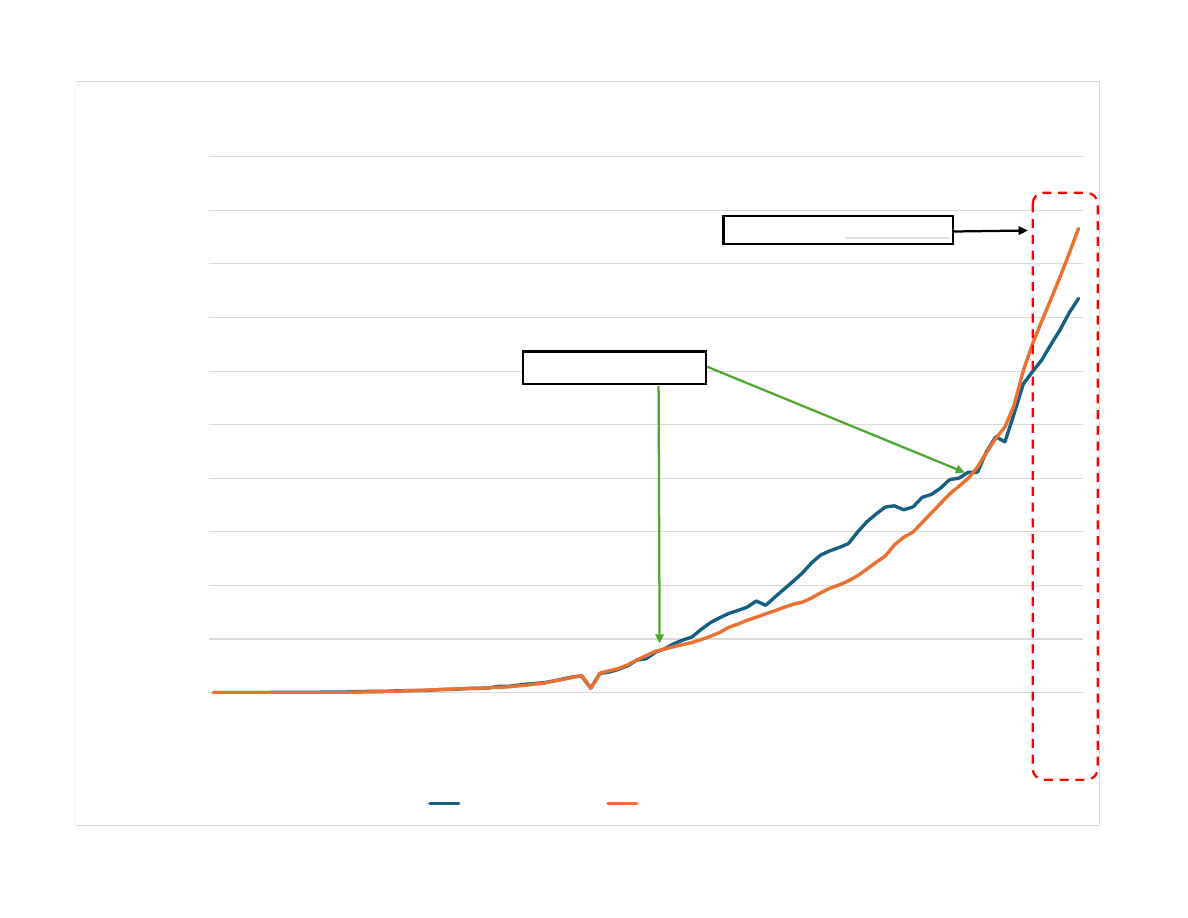

1 Case for Amending U.S. Constitution: Balanced Budget Written by Mr. Michael D. Forbis August 30, 2024 Overview. This short paper attempts to provide a simple and objective explanation for the basis of adding an amendment to the U.S. Constitution that addresses the need to have an established Balanced Budget. It serves as a starting and reference point to inform further discussion and development of the final amendment structure. Disclaimer. The views expressed in this work are those of the author and do not necessarily represent the views of Convention of States Action (COSA), its staff, or affiliates.  2 The federal government lacks discipline to establish a balanced budget each fiscal year, and an amendment to the U.S. Constitution is necessary to rectify this situation. The potential amendment can simply be written in the following manner. • Section 1: Total federal outlays shall not exceed total federal receipts for each fiscal year. Total federal outlays shall include all outlays of the United States, including those for repayment on federal debt principal plus interest. Total receipts shall include all receipts of the United States except that derived from borrowing. • Section 2: At least five percent of any fiscal year budget shall be applied to the outstanding federal debt principal plus interest. • Section 3: Congress, whenever three fifths of both chambers by roll call deem it necessary, may allow outlays to exceed receipts in section one for one fiscal year by borrowing in accordance with the second clause of section eight of Article One of this Constitution. • Section 4: Congress, whenever three fifths of both chambers by roll call deem it necessary, may vote to raise Taxes, Duties, Imposts, or Excises to increase receipts for one fiscal year in accordance with the first clause of section eight of Article One of this Constitution. • Section 5: This amendment shall take effect in the third fiscal year after its ratification. The first and second clauses in Article I of the U.S. Constitution are depicted below. • First Clause: “The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States. • Second Clause: “To borrow Money on the credit of the United States.” Basically, a balanced budget means that outlays do not exceed receipts. Since 1901, the Federal Government has operated on a balanced budget 23.8% of the time (see Figure 1), and this historical pattern by the Federal Government is a very poor track record. In those years where a deficit occurred, the Federal Government had to vote on increasing the federal debt limit every time, and it is the greatest single factor for the increasing federal debt. In addition, the President's Budget submission from March 2024 included an estimate for FY25-29, and there is absolutely no attempt to ensure outlays do not exceed receipts within these estimates. In fact, the President's Budget submission estimates the federal debt will reach $44 Trillion by FY29, and the current federal debt is approximately $35 Trillion (see Figure 2). 1 It is approximately a 25% increase in only 5 years from now. It seems the Federal Government anticipates just voting to increase the federal debt limit every year as the historical pattern suggests. 1 Source: www.govinfo.gov/app/collection/budget/ - Historical Tables 1.1, 7.1, & 7.3. These tables include historical federal budget information, and it is readily available to the public.  3 Figure 1: Federal Budget Historical Record (Outlays vs. Receipts)  4 Figure 2: Historical United States Federal Debt  5 By 1979, there were two-thirds (34 of 50) of the states who submitted an Article V convention application to address a single issue for a Balanced Budget Amendment to the U.S. Constitution. By 1982, this number reached 40 states, but there was no evidence of Congress calling for an Article V convention for the sole purpose of developing a proposed Balanced Budget Amendment. 2 Based on Congressional Record, the 97th Congress (1981-1982) decided to address the Balanced Budget Amendment by crafting a version of it and then voting on it. Basically, it was substituting this action for a formal Article V convention by the 40 states. This first attempt by the 97th Congress was somewhat successful when it passed by two-thirds in the Senate but failed in the House. The Congressional Record also shows the 99th Congress (1985- 1986), 101st Congress (1989-1990), 102nd Congress (1991-1992), 103rd Congress (1993-1994), 104th Congress (1995-1996), 105th Congress (1997-1998), 112th Congress (2011-2012), and 115th Congress (2017-2018) all made attempts to pass a proposed Balanced Budget Amendment to the U.S. Constitution but all failed. The 104th Congress was the closest to success, but it came up short by 2-votes within the U.S. Senate on 2 separate occasions. The House passed it by 69.4% on its first attempt (see Annex A for Historical Summary). 3 By 2023, there were some states that rescinded / changed their Article V convention application for a Balanced Budget Amendment, and the current count stands at 31 states remaining. 4 Congress made some reasonable attempts to propose a Balanced Budget Amendment, but there were different issues with each attempt. However, there was one common theme with all the attempts, and it was that “total outlays do not exceed total receipts.” Thus, the U.S. Congress essentially acknowledged the basic idea that a Balanced Budget Amendment involves outlays not exceeding receipts. While this is a good discovery, the fact remains that Congress still could not pass a proposed amendment. At this point in history, an Article V convention is likely the better option for developing a proposed Balanced Budget Amendment, and it can be incorporated into a convention that examines multiple issues rather than just a single one. Most importantly, the Article V convention can dedicate more time and careful examination towards a proposed Balanced Budget Amendment without the distractions of facing other legislative priorities that confronts the U.S. Congress. The foundation of a Balanced Budget Amendment is structural and procedural in nature, and it does not include provisions related to economic conditions or specific budget items. For example, the federal debt can be compared to the gross domestic product (GDP) of the United States (see Annex B pages B-1 to B-2), and total outlays and receipts can be compared to the GDP (see Annex B page B-3). The inclusion of an economic condition like GDP to determine the limit of the total federal debt or proportion of federal outlays in a fiscal year is beyond the 2 Source: http://article5library.org/analyze.php - the Article V Library is a repository of information tracking Article V convention applications on various topics. Select “Applications by Subject” and choose subject matter “Balanced Budget.” 3 Congressional Research Service (CRS) report R41907, A Balanced Budget Constitutional Amendment: Background and Congressional Options , dated August 22, 2019 ( https:%%//%%crsreports.congress.gov ). See www.congress.gov for specific archive summary for each specific House and Senate resolutions described in CRS report R41907. Summary outlined in Annex A. 4 See http://article5library.or/analyze.php  6 scope of federal control. In addition, the inclusion of a specific budget item such as Social Security or National Defense (i.e., declaration of war) as a specific exception within the amendment creates additional complications beyond the intent of an overall Balanced Budget (see Annex B pages B-4 to B-5). 5 During the 112 th Congress (2011-2012), specific economic conditions like GDP and Social Security were included in two different amendment versions, but they were met with drastic defeat (see Annex A page A-4). Even during some of the committee hearings in other Congressional sessions proposing amendments, amendment versions incorporating economic conditions or specific budget items were consistently rejected. 6 Based on these historical lessons, a proposed amendment for a Balanced Budget should not include provisions related to economic conditions or specific budget items. However, the structural and procedural composition of the Balanced Budget amendment provides flexibility when specific exceptions may need to occur involving economic conditions or specific budget items. Finally, this Balanced Budget amendment complements an overall Federal Budget Timeline amendment. However, there is no guarantee both amendments will become part of the U.S. Constitution. It is possible for this Balanced Budget amendment to be adopted without the Federal Budget Timeline amendment, and this potential result is still better than the status quo. Therefore, the introduction of two distinct but related amendments ensure a greater probability of success to improve the overall federal budget than if both were compiled into one “mega” amendment. Annexes: A. Historical Balanced Budget Amendments – Full House or Senate Floor Consideration (pages A-1 to A-4) B. Supporting Historical Budget Data Charts (pages B-1 to B-5) 5 Source: www.govinfo.gov/app/collection/budget/ - Historical Tables 1.3, 4.1, 7.1, & 13.1. These tables include historical federal budget information, and it is readily available to the public. Summary outlined in Annex B. 6 See pages 11-20 of Congressional Research Service (CRS) report R41907, A Balanced Budget Constitutional Amendment: Background and Congressional Options , dated August 22, 2019 ( https:%%//%%crsreports.congress.gov ).  Congress Session Proposed Amendment Concept Senate Vote House Vote 97th Congress (1981-1982) Requires Congress, prior to each fiscal year, to adopt a statement of receipts and outlays for that year in which total outlays are no greater than total receipts. Permits Congress in such statement to provide for a specific excess of outlays over receipts by a three-fifths vote directed solely to that subject. Prohibits total receipts for any fiscal year set forth in such statement from increasing by a rate greater than the rate of increase in national income in the last calendar year ending before such fiscal year, unless Congress passes a bill directed solely to approving specific additional receipts and such bill has become law. Permits Congress to waive the provisions of this Act with respect to any fiscal year in which a declaration of war is in effect. Declares that total receipts shall include all receipts of the United States, except those derived from borrowing and total outlays shall include all outlays of the United States except those for repayment of debt principal. Declares that on and after the date this article takes effect, the amount of Federal public debt limit as of such date shall become permanent and there shall be no increase in such amount unless three-fifths of the Congress passes a bill approving such increase and such bill has become law. Makes this article effective for the second fiscal year beginning after its ratification. 69-31 (Passed) August 4, 1982 S.J. Res 58 236-187 (55.8%, not passed) October 1, 1982 H.J. Res 350 99th Congress (1985-1986) Prohibits Federal outlays from exceeding Federal receipts in any fiscal year, unless the Congress provides for a specific excess by a three-fifths vote of both Houses. Authorizes the Congress to waive this article for any year in which a declaration of war is in effect 66-34 (Not Pass) (1-vote short) March 25, 1986 S.J. Res 225 N/A 101st Congress (1989-1990) Requires the Congress and the President, prior to each fiscal year, to establish an estimate of total receipts (except those derived from borrowing) for that fiscal year by enactment of a law devoted solely to that subject. Prohibits outlays for that year (except those for repayment of debt principal) from exceeding this amount unless the Congress, by a three- fifths roll call vote of each House, shall provide for a specific excess of outlays over estimated receipts. Requires a three-fifths roll call vote of each House to increase the public debt. Directs the President to submit a balanced budget to the Congress. Requires the approval of a majority of the total membership of each House by roll call vote before any bill to increase revenue may become law. Waives these provisions when a declaration of war is in effect. Makes this article effective beginning with FY 1995 or with the second fiscal year after its ratification, whichever is later. N/A 279-150 (65%) (Not Pass) (7 votes short) H.J. Res 268 July 17 , 1990 Annex A: Historical Summary Proposed Balanced Budget Amendments - Full House or Senate Floor Consideration Sources: www.congress.gov and CRS Report R41907 (www.crsreports.congress.gov) A-1  Congress Session Proposed Amendment Concept Senate Vote House Vote Annex A: Historical Summary Proposed Balanced Budget Amendments - Full House or Senate Floor Consideration Sources: www.congress.gov and CRS Report R41907 (www.crsreports.congress.gov) 102nd Congress (1991-1992) Prohibits total outlays for any fiscal year (except those derived from borrowing) from exceeding total receipts (except those for repayment of debt principal) unless the Congress, by a three-fifths roll call vote of each House, authorizes a specific excess of outlays over receipts. Requires a three-fifths roll call vote of each House to increase the public debt. Directs the President to submit a balanced budget to the Congress. Requires the approval of a majority of the total membership of each House by roll call vote before any bill to increase revenue may become law. Waives these provisions when a declaration of war is in effect. Waives these provisions when the United States is engaged in military conflict which causes an imminent and serious military threat to national security and is so declared by a joint resolution adopted by a majority of the whole number of each House, which becomes law. Directs the Congress to enforce and implement this article by appropriate legislation which may rely on estimates of outlays and receipts. Makes this article effective beginning with FY 1998 or with the second fiscal year after its ratification, whichever is later. N/A, did have discussion of a different version. Did not make it to a full Senate Floor vote. 280-153 (64.6%) (Not Pass) (9-votes short) H.J. Res 290 June 11, 1992 103rd Congress (1993-1994) S.J. Res 21 : Prohibits in any fiscal year total Federal outlays from exceeding total receipts, unless a three-fifths roll call vote of both Houses of Congress authorizes a specific excess. Prohibits any increases in the public debt unless a three-fifths roll call vote of both Houses enacts legislation permitting otherwise. Directs the President to submit a balanced budget to the Congress. Permits any revenue-increasing bill to become law only if approved by a majority of the whole number of each House by roll call vote. Waives these provisions when a declaration of war is in effect. H.J. Res 103 : Prohibits outlays for a fiscal year (except those for repayment of debt principal) from exceeding total receipts (except those derived from borrowing) for that fiscal year unless the Congress, by a three-fifths roll call vote of each House, authorizes a specific excess of outlays over receipts. Requires a three-fifths roll call vote of each House to increase the public debt. Directs the President to submit a balanced budget to the Congress. Requires the approval of a majority of each House by roll call vote before any bill to increase revenue may become law. Waives these provisions when a declaration of war is in effect. Waives these provisions when the United States is engaged in a military conflict which poses a threat to national security as declared by a joint resolution adopted by a majority of each House. Makes this amendment effective beginning with FY 2001 or the second fiscal year after its ratification, whichever is later. 63-37 (Not Pass) (3-votes short) S.J. Res 41 March 1, 1994 271-153 (63.9%) (Not Pass) (12-votes short) H.J. Res 103 March 17, 1994 A-2  Congress Session Proposed Amendment Concept Senate Vote House Vote Annex A: Historical Summary Proposed Balanced Budget Amendments - Full House or Senate Floor Consideration Sources: www.congress.gov and CRS Report R41907 (www.crsreports.congress.gov) 104th Congress (1995-1996) Prohibits total outlays from exceeding total receipts for a fiscal year, unless three-fifths of the members of each House of Congress provide by law for a specific excess of outlays over receipts by a roll call vote. Sets a permanent limit on the amount of the public debt. Prohibits an increase in such amount unless approved by a three-fifths majority in each House by roll call vote. Directs the President to submit a balanced budget. Prohibits a bill to increase revenue from becoming law unless approved by a majority in each House by roll call vote. Waives the provisions of this amendment for any fiscal year in which a declaration of war is in effect, or if the United States faces an imminent and serious military threat to national security as declared by a joint resolution which becomes law. 1st Vote: 65-35 (Not Pass) (2-votes short) March 2, 1995 H.R. Res 1 2nd Vote: 64-35 (Not Pass) (2-votes short) June 6, 1996 H.J. Res 1 300-132 (69.4%) (Passed) January 26, 1995 H.J. Res 1 105th Congress (1997-1998) Prohibits outlays for a fiscal year (except those for repayment of debt principal) from exceeding total receipts (except those derived from borrowing) for that fiscal year unless the Congress, by a three-fifths roll call vote of each House, authorizes a specific excess of outlays over receipts. Requires a three-fifths roll call vote of each House to increase the public debt. Directs the President to submit a balanced budget to the Congress. Requires the approval of a majority of each House by roll call vote before any bill to increase revenue may become law. Authorizes the Congress to waive these provisions when: (1) a declaration of war is in effect; or (2) the United States is engaged in a military conflict which poses a threat to national security as declared by a joint resolution adopted by a majority of each House. Makes this article effective beginning with FY 2002 or with the second fiscal year beginning after its ratification, whichever is later. 66-34 (Not Pass) (1-vote short) March 4, 1997 S.J. Res 1 N/A 112th Congress (2011-2012) H.J. Res 2 : Prohibits outlays for a fiscal year (except those for repayment of debt principal) from exceeding total receipts for that fiscal year (except those derived from borrowing) unless Congress, by a three-fifths rollcall vote of each chamber, authorizes a specific excess of outlays over receipts. Requires a three-fifths rollcall vote of each chamber to increase the public debt limit. Directs the President to submit a balanced budget to Congress annually. Prohibits any bill to increase revenue from becoming law unless approved by a majority of each chamber by rollcall vote. Authorizes waivers of these provisions when a declaration of war is in effect or under other specified circumstances involving military conflict. N/A 261-165 (61.2%) (Not Pass) November 18, 2011 H.J. Res 2 A-3  Congress Session Proposed Amendment Concept Senate Vote House Vote Annex A: Historical Summary Proposed Balanced Budget Amendments - Full House or Senate Floor Consideration Sources: www.congress.gov and CRS Report R41907 (www.crsreports.congress.gov) 112th Congress (2011-2012) S.J. Res 24 Prohibits outlays for a fiscal year (except those for repayment of debt principal) from exceeding total receipts for that fiscal year (except those derived from borrowing) unless Congress, by a three-fifths roll call vote of each chamber, authorizes a specific excess of outlays over receipts. Excludes receipts (including attributable interest) and outlays of the Federal Old-Age and Survivors Insurance Trust Fund and the Federal Disability Insurance Trust Fund, or either of their successor funds, from consideration as receipts or outlays for purposes of this Amendment. Directs the President to submit a balanced budget to Congress annually. Authorizes waivers of these provisions when a declaration of war is in effect or under other specified circumstances involving military conflict. Prohibits Congress from passing any bill that provides a net reduction in individual income taxes for those with incomes over $1 million (as may be adjusted by Congress to account for inflation) if, after enactment, total outlays would exceed total receipts in any fiscal year affected by the bill. Prohibits a federal or state court from ordering any reduction in the Social Security benefits authorized by law, including any benefits provided from the Federal Old-Age and Survivors Insurance Trust Fund, the Federal Disability Insurance Trust Fund, or either of their successor funds. 21-70 (Not Pass) December 14, 2011 S.J. Res 24 N/A 112th Congress (2011-2012) S.J. Res 10: Prohibits outlays for a fiscal year (except those for repayment of debt principal) from exceeding total receipts for that fiscal year (except those derived from borrowing) unless Congress, by a two-thirds roll call vote of each chamber, authorizes a specific excess of outlays over receipts. Prohibits total outlays for any fiscal year from exceeding 18% of the gross domestic product (GDP) for the preceding calendar year unless Congress, by a two-thirds roll call vote of each chamber, authorizes a specific excess over such 18%. Directs the President to submit a balanced budget to Congress annually. Prohibits any bill from becoming law that imposes a new tax or increases the statutory rate of any tax or the aggregate amount of revenue, unless approved by a two-thirds roll call vote of each chamber. Requires a three-fifths roll call vote of each chamber to increase the federal debt limit. Authorizes waivers of these requirements: (1) when a declaration of war is in effect against a nation-state and Congress, by a majority roll call vote of each chamber, authorizes a specific excess; or (2) under other specified circumstances involving military conflict, if Congress, by a three-fifths roll call vote of each chamber, authorizes such waiver. Prohibits a federal or state court from ordering any increase in revenue to enforce this article. 47-53 (Not Pass) December 14, 2011 S.J. Res 10 N/A 115th Congress (2017-2018) H.J. Res 2: This joint resolution proposes a constitutional amendment prohibiting total outlays for a fiscal year from exceeding total receipts for that fiscal year unless Congress authorizes the excess by a three-fifths roll call vote of each chamber. The prohibition excludes outlays for repayment of debt principal and receipts derived from borrowing. The amendment requires a three-fifths roll call vote of each chamber of Congress to increase the public debt limit. It requires a majority roll vote of each chamber to increase revenue. It also requires the President to submit a balanced budget to Congress annually. Congress is authorized to waive these requirements when a declaration of war is in effect or if the United States is engaged in a military conflict which causes an imminent and serious military threat to national security. N/A 233-184 (55.8%) (Not Pass) January 3, 2017 H.J. Res 2 A-4  $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 1940 1942 1944 1946 1948 1950 1952 1954 1956 1958 1960 1962 1964 1966 1968 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 20 24 E 20 26 E 20 28 E B ill ion s of D ol lars ($) FISCAL YEAR Annex B: Historical Gross Domestic Product (GDP) and Total Federal Debt (page B-1) (Source: www.govinfo.gov/app/collection/budget/ - Historical Table 7.1) Gross Domestic Product (GDP) Total Federal Debt  0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 19 40 19 42 19 44 19 46 19 48 19 50 19 52 19 54 19 56 19 58 19 60 19 62 19 64 19 66 19 68 19 70 19 72 19 74 19 76 19 79 19 81 19 83 19 85 19 87 198 9 199 1 199 3 19 95 19 97 19 99 20 01 20 03 20 05 20 07 20 09 20 11 20 13 20 15 20 17 20 19 20 21 20 23 20 25 E 20 27 E 20 29 E FISCAL YEAR Annex B: Federal Debt to Gross Domestic Product (GDP) Ratio (a.k.a. Real Debt) (page B-2) (Source: www.govinfo.gov/app/collection/budget/ - Historical Table 7.1) World War II President's Budget Estimate  0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 1 9 4 0 19 42 19 44 19 46 19 48 19 50 19 52 19 54 19 56 1 9 5 8 19 60 19 62 19 64 19 66 19 68 19 70 19 72 19 74 19 76 19 77 19 79 19 81 1 9 8 3 19 85 19 87 19 89 19 91 19 93 19 95 19 97 19 99 2 0 0 1 20 03 20 05 20 07 20 09 20 11 20 13 20 15 20 17 20 19 20 21 20 23 20 25 E 20 27 E 20 29 E P er ce n tage o f G ro ss Do mest ic P ro d u ct (G DP ) FISCAL YEAR Annex B: Historical Federal Budget Receipts and Outlays as % of GDP (page B-3) (Source: www.govinfo.gov/app/collection/budget/ - Historical Table 1.3) Receipts Outlays  $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 $2,000,000 19 36 19 38 19 40 19 42 19 44 19 46 19 48 19 50 19 52 19 54 19 56 19 58 19 60 19 62 19 64 19 66 19 68 19 70 19 72 19 74 19 76 19 77 19 79 19 81 19 83 19 85 19 87 19 89 19 91 19 93 19 95 19 97 19 99 20 01 20 03 20 05 20 07 20 09 20 11 20 13 20 15 20 17 20 19 20 21 20 23 20 25 E 20 27 E 20 29 E M ill ion s of D ollar s ($ ) FISCAL YEAR Annex B: Old-Age and Survivors Insurance (OASI) Fund - Cash Income and Cash Outgo (page B-4) (a.k.a. Social Security) (Source: www.govinfo.gov/app/collection/budget/ - Historical Table 13.1) Total cash income Total cash outgo Surplus Years: 1984-2017 Future Pattern is not sustainable  0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% 19 62 19 64 19 66 19 68 19 70 19 72 19 74 19 76 19 78 19 80 19 82 19 84 19 86 19 88 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 20 08 20 10 20 12 20 14 20 16 20 18 20 20 20 22 20 24 E 20 26 E 2 0 2 8 E Percent ag e of Federa l B udg et E xpen dit ures FISCAL YEAR (Annex B: Historical Federal Budget Expenditures by Key Departments (page B-5) (Source: www.govinfo.gov/app/collection/budget/ - Historical Table 4.1) Agriculture Defense Health and Human Services Treasury Veterans Affairs Social Security Administration (Off-Budget) Social Security Administration (On-Budget) 7 of 32 Federal Departments / Categories make up approximately 90% of the overall Federal Budget Expenditures Presidential Budget Estimate |

| Page Metadata | |

| Login Required to view? | No |

| Created: | 2025-03-14 23:47 GMT |

| Updated: | 2025-03-14 23:47 GMT |

| Published: | 2025-03-14 23:47 GMT |

| Converted: | 2025-11-11 12:35 GMT |

| Change Author: | Vivian Garcia |

| Credit Author: | Mike Forbis |

public/cb_mirror/co_document_library_case_for_series_part_4_pdf_files_28756.txt · Last modified: 2025/11/11 12:35 by 127.0.0.1