To view this on the COS website, click here 2025-texas-constitutional-amendments

To download the pdf file from the COS website, click here 2025_Texas_Constitutional_Amendments_Voters_Guide_v0_-COSTexas.pdf

2025 Texas Constitutional Amendments

Attachment: 4786/2025TexasConstitutionalAmendmentsVotersGuidev0-COSTexas.pdf

|

2025

Constitutional Amendments

Voter’s Guide

© 2025

A qr code with a star in the middle

AI-generated content may be incorrect.

Download Digital Copy

Compiled By Darren York

© 2025

txconstitutionalamendments.org

This Voter’s Guide is a compilation of publicly available information from the referenced

sources for voter educational and informational purposes only.

This guide is copyrighted for commercial purposes only. This guide is free to use, copy and

distribute for the sole purpose of voter education and information. This guide if used, copied or

distributed must be done free of charge regardless of the medium that it is provided, printed or

electronic).

For questions, feedback, request or to report unauthorized use or distribution of this guide,

please contact Darren York at

//[email protected]//

.

© 2025 by Darren York for 2025 Constitutional Amendments Voter’s Guide

Copyright and Permitted Use

© 2025

2

DIGITAL VERSION

This Voter’s Guide is available in a digital PDF version. In the digital version the QR codes are

hyperlinked to the source data/information unless a text URL link is provided in conjunction

with the QR code.

PRINTER VERSION

This Voter’s Guide if printed, provides QR codes for all references to source data/information

for the user’s ease of use, to provide easy digital access to the source data/information.

DATA / INFORMATION

The data/information provided in this guide is sourced from publicly available information with

the primary sources being provided from the Texas Constitution and Legislative Records

accessed through

//Texas Legislature Online//

.

ORGANIZATION

The Guide is organized to provide detailed information on each amendment proposition. At the

end of the detailed section is a reference summary to provide legislative links for fiscal notes,

bill analysis, and an enrolled bill summary. A second summary is provided with links for the full

text versions of the joint resolutions as well as any associated enabling legislation. The Guide

concludes with a Proposition Notes section that can be printed, completed and used as a

voting memory aid based when the user cast their ballot.

About This Guide

© 2025

3

How Is The Texas Constitution Amended? …………………………….

The History of the Texas Constitution & Amendments …………….

Voting Information ……………………………………………………………

Propositions Voter Information

Proposition 1 ……………………………………………………………………

Proposition 2 ……………………………………………………………………

Proposition 3 ……………………………………………………………………

Proposition 4 ……………………………………………………………………

Proposition 5 ……………………………………………………………………

Proposition 6 ……………………………………………………………………

Proposition 7 ……………………………………………………………………

Proposition 8 ……………………………………………………………………

Proposition 9 ……………………………………………………………………

Proposition 10 …………………………………………………………………

Proposition 11 …………………………………………………………………

Proposition 12 …………………………………………………………………

Proposition 13 …………………………………………………………………

Proposition 14 …………………………………………………………………

Contents

© 2025

4

6

7

12

13

14

16

18

20

22

24

26

28

30

32

34

36

38

40

Proposition 15 …………………………………………………………………

Proposition 16 …………………………………………………………………

Proposition 17 …………………………………………………………………

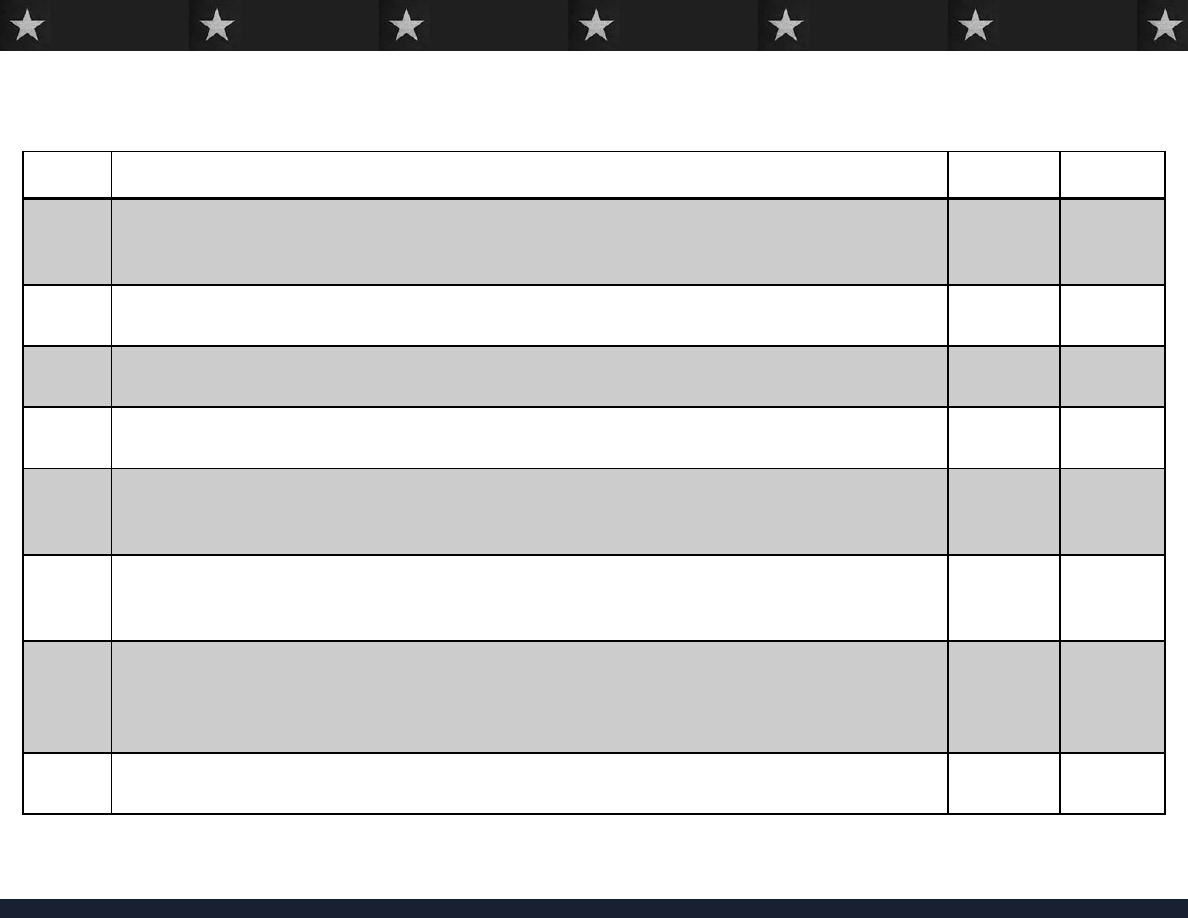

Additional References ………………………………………………………

By Proposition (Fiscal Notes, HRO Analysis, Enrolled Summary …..

By Proposition (Joint Resolution Text & Enabling Legislation ………..

All Propositions ……………………………………………………………….

Secretary of State Ballot Order (English/Spanish)

Secretary of State Proposition Explanatory Statements

(English/Spanish)

BallotPedia Proposition List / Details

Voter’s Notes …………………………………………………………………..

Contents

© 2025

5

42

44

46

48

48

49

50

51

How Is The Texas Constitution Amended?

1

2

The Texas Legislature must pass a joint

resolution proposing the constitutional

amendment with a two-thirds majority vote

in both the Texas House of Representatives

(100 votes) and the Texas Senate (21

votes)

Once the joint resolution is passed, the

proposed amendment is then submitted to

Texas voters for approval in a special

election (typically in November of odd

numbered years). The amendment becomes

part of the constitution if it receives a

majority of the votes cast.

Unlike bills, joint resolutions do not require the governor's signature and are filed directly with the secretary of state.

The Texas Two Step

© 2025

6

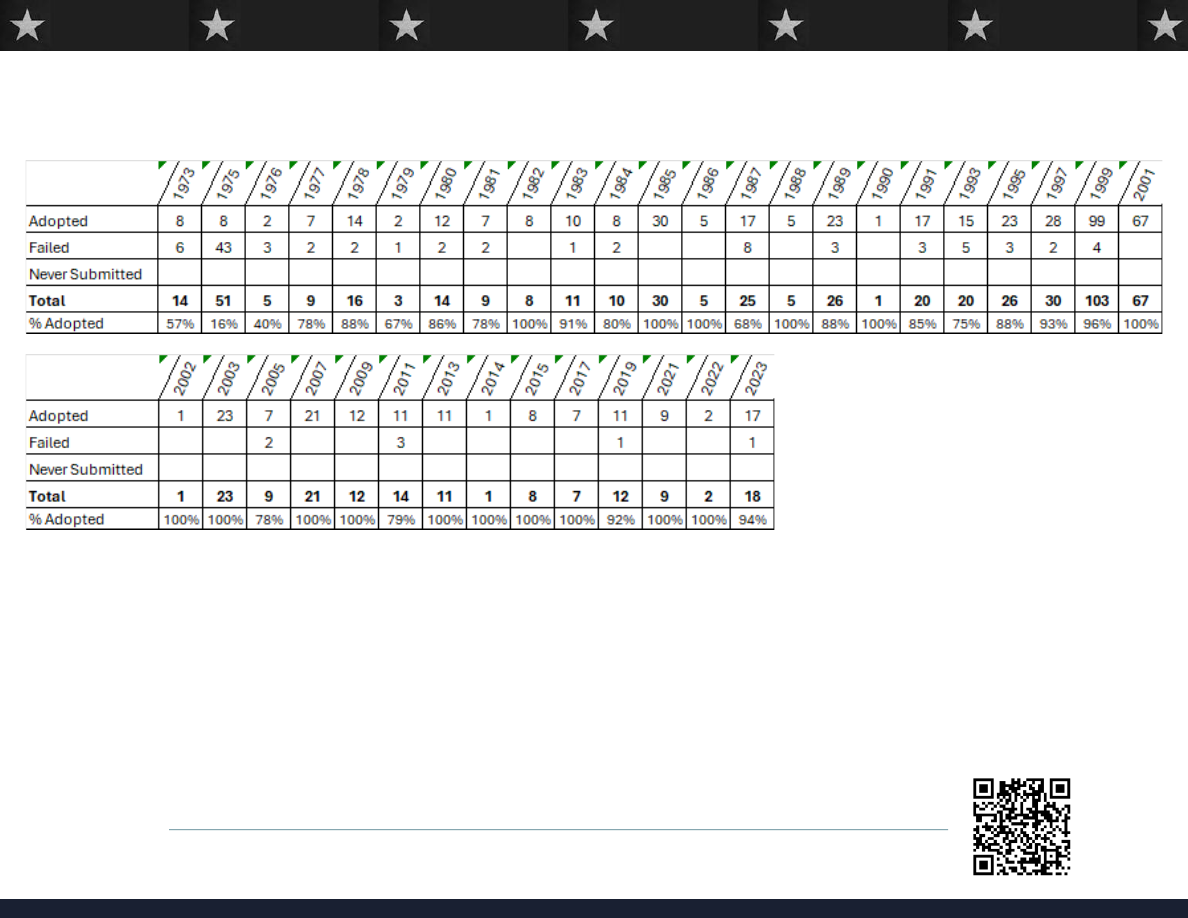

The History of the Texas Constitution and Its Amendments

The 1876 Texas Constitution, the fifth since statehood, had 289 sections organized into 17

articles.

Over the years, 234 new sections have been added, while 66 of the original sections and 52 of

the added sections have been removed, so that the Texas Constitution today has 405 sections.

Since 1876, the legislature has proposed 714 constitutional amendments. Of those

amendments, 530 have been approved by the electorate, 181 have been defeated, and 3

never made it to the ballot.

//https:%%//%%www.tlc.texas.gov/docs/amendments/constamend1876.pdf//

The Texas Constitution as amended through November 7, 2023 may

be found at the following link:

//https:%%//%%www.tlc.texas.gov/docs/legref/TxConst.pdf//

© 2025

7

© 2025

8

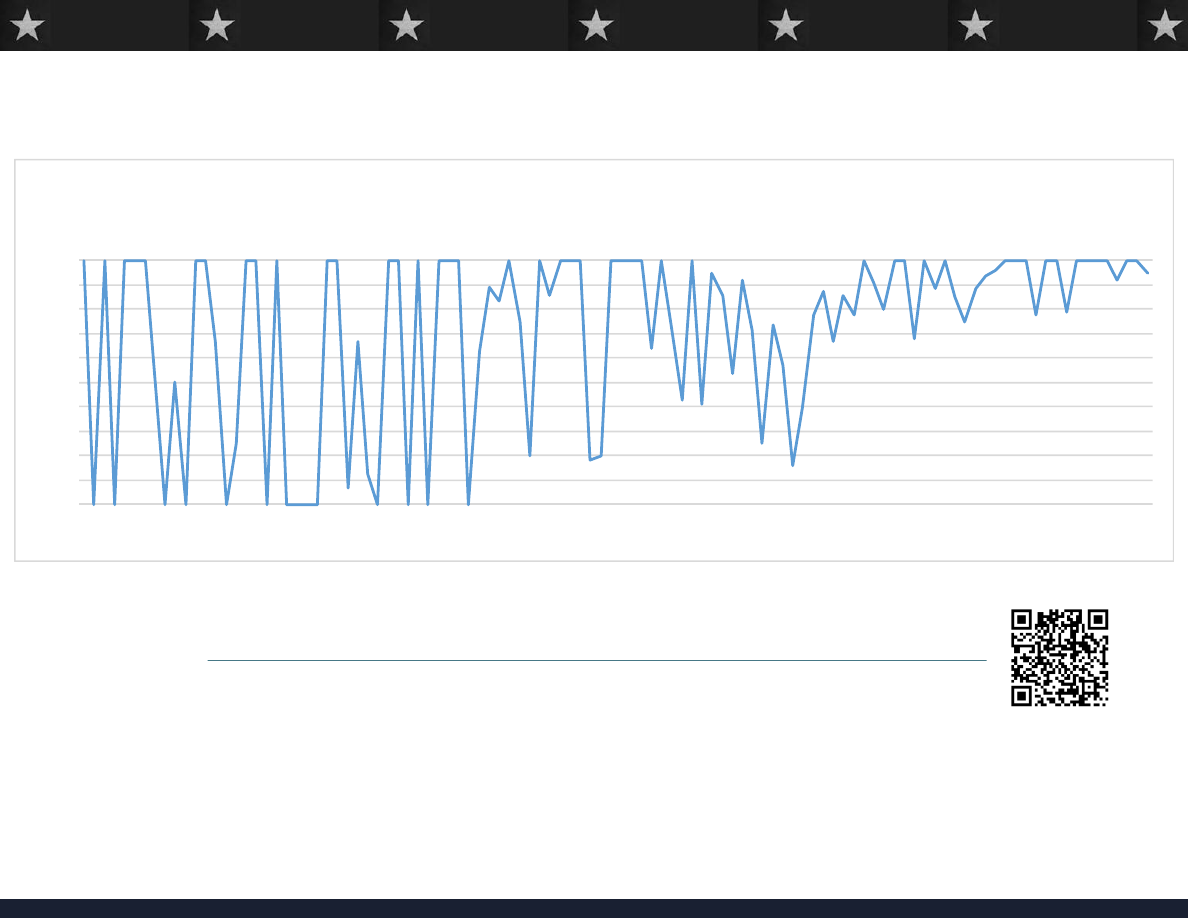

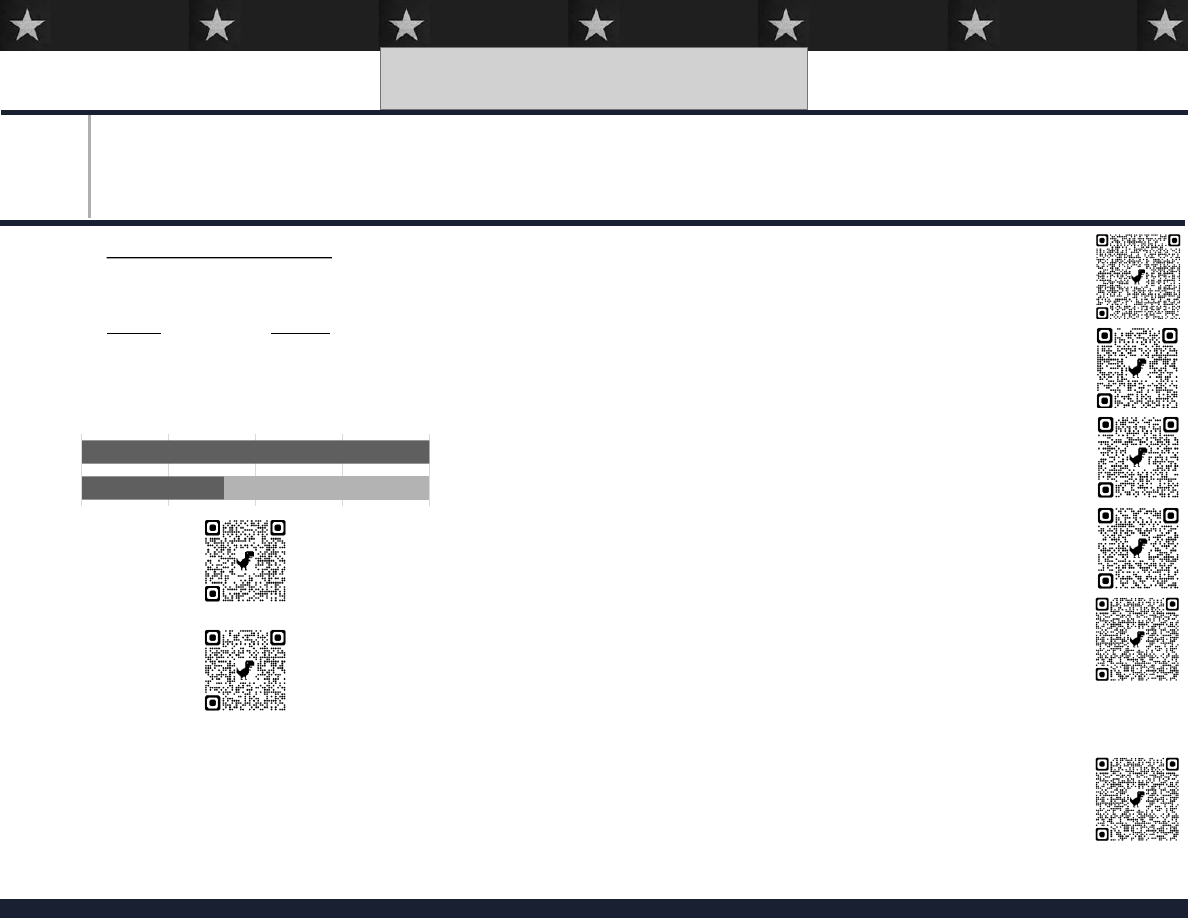

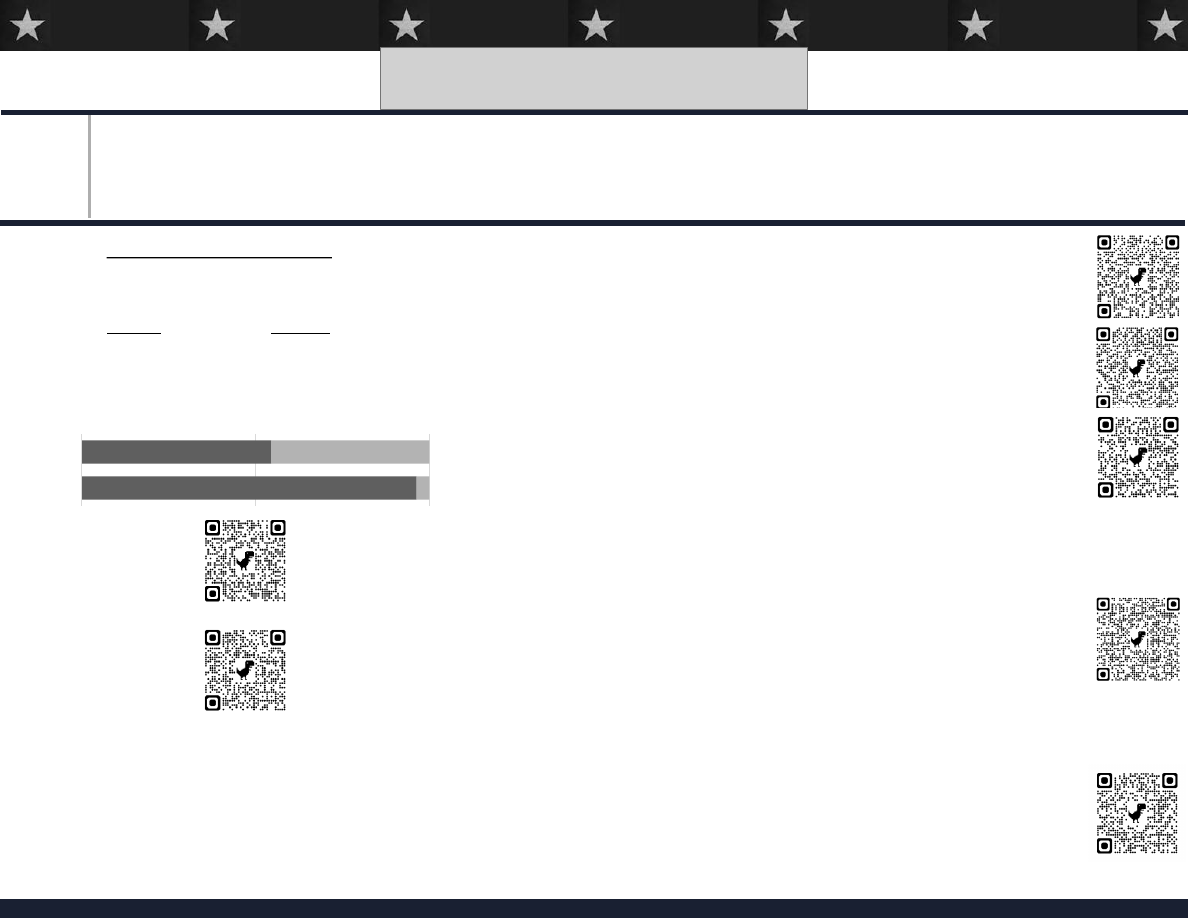

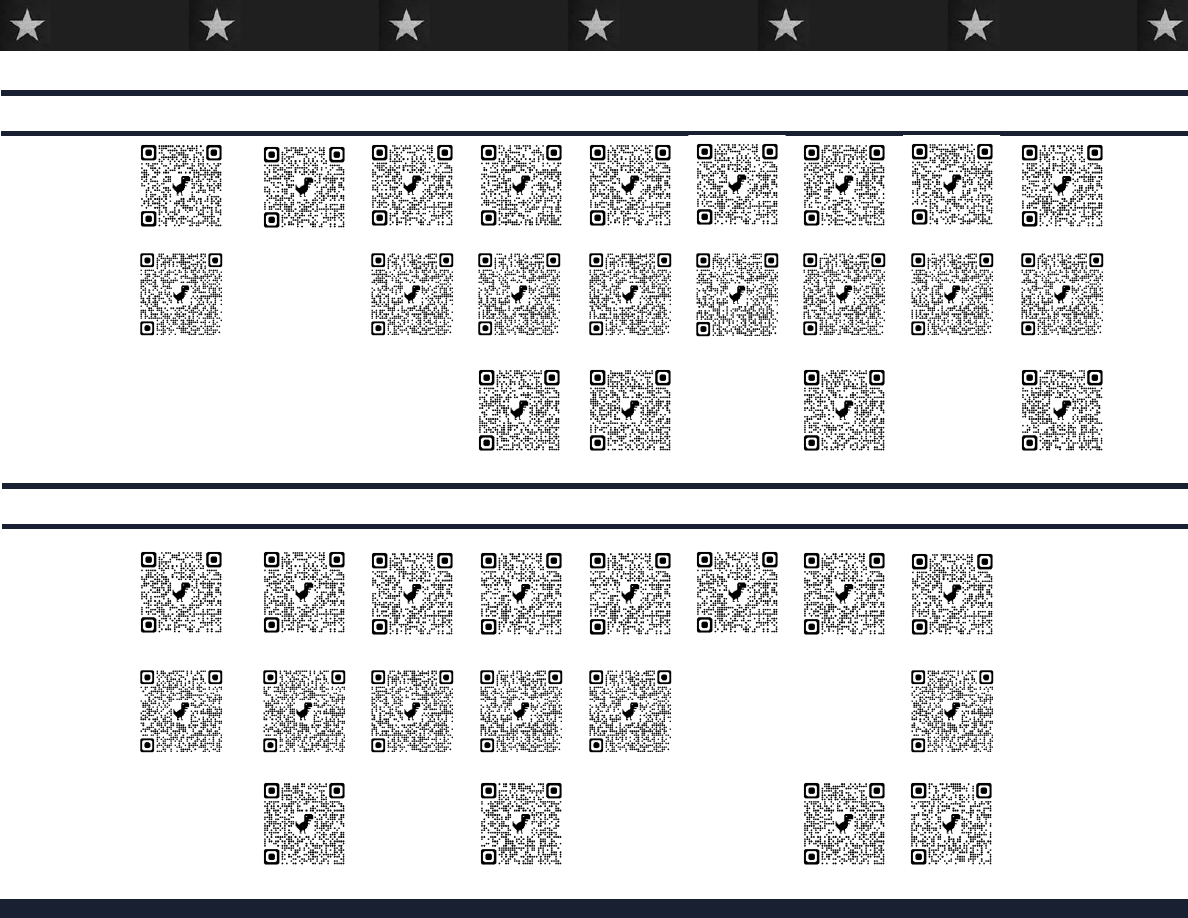

The History of Texas Constitutional Amendments

//https:%%//%%www.tlc.texas.gov/docs/amendments/constamend1876.pdf//

© 2025

9

The History of Texas Constitutional Amendments

//https:%%//%%www.tlc.texas.gov/docs/amendments/constamend1876.pdf//

© 2025

10

The History of Texas Constitutional Amendments

//https:%%//%%www.tlc.texas.gov/docs/amendments/constamend1876.pdf//

19

16

19

17

19

18

19

19

19

20

19

21

19

23

19

24

19

26

19

27

19

28

19

29

19

30

19

32

19

33

19

34

19

35

19

36

19

37

19

38

19

40

19

42

19

44

19

45

19

46

19

47

19

48

19

49

19

51

19

52

19

54

19

56

19

57

19

58

19

60

19

62

19

63

19

64

19

65

19

66

19

67

19

68

19

69

19

70

19

71

19

72

19

73

19

75

19

76

19

77

19

78

19

79

19

80

19

81

19

82

19

83

19

84

19

85

19

86

19

87

19

88

19

89

19

90

19

91

19

93

19

95

19

97

19

99

20

01

20

02

20

03

20

05

20

07

20

09

20

11

20

13

20

14

20

15

20

17

20

19

20

21

20

22

20

23

Adopted

1

2

1

2

1

1

5

4

6

12

4

5

8

5

1

3

1

3

Failed

1

14

1

7

9

3

8

3

1

1

1

4

Never Submitted

1

Total

1

1

2

15

3

8

1

1

5

9

4

3

6

12

4

8

8

9

6

1

4

5

3

% Adopted

0% 100% 100% 7%

67% 13%

0% 100% 100% 0% 100% 0% 100% 100% 100% 0%

63% 89% 83% 100% 75% 20% 100%

19

45

19

46

19

47

19

48

19

49

19

51

19

52

19

54

19

56

19

57

19

58

19

60

19

62

19

63

19

64

19

65

19

66

19

67

19

68

19

69

19

70

19

71

19

72

19

73

19

75

19

76

19

77

19

78

19

79

19

80

19

81

19

82

19

83

19

84

19

85

19

86

19

87

19

88

19

89

19

90

19

91

19

93

19

95

19

97

19

99

20

01

20

02

20

03

20

05

20

07

20

09

20

11

20

13

20

14

20

15

20

17

20

19

20

21

20

22

20

23

Adopted

6

4

2

9

2

1

2

29

11

3

7

6

11

3

3

7

18

6

8

55

5

1

14

Failed

1

9

4

4

4

4

10

1

7

5

2

3

5

Never Submitted

1

Total

7

4

2

9

11

5

2

29

11

3

11

6

15

7

3

17

19

7

15

60

7

4

19

% Adopted

86% 100% 100% 100% 18% 20% 100% 100% 100% 100% 64% 100% 73% 43% 100% 41% 95% 86% 53% 92% 71% 25% 74%

© 2025

11

The History of Texas Constitutional Amendments

//https:%%//%%www.tlc.texas.gov/docs/amendments/constamend1876.pdf//

© 2025

12

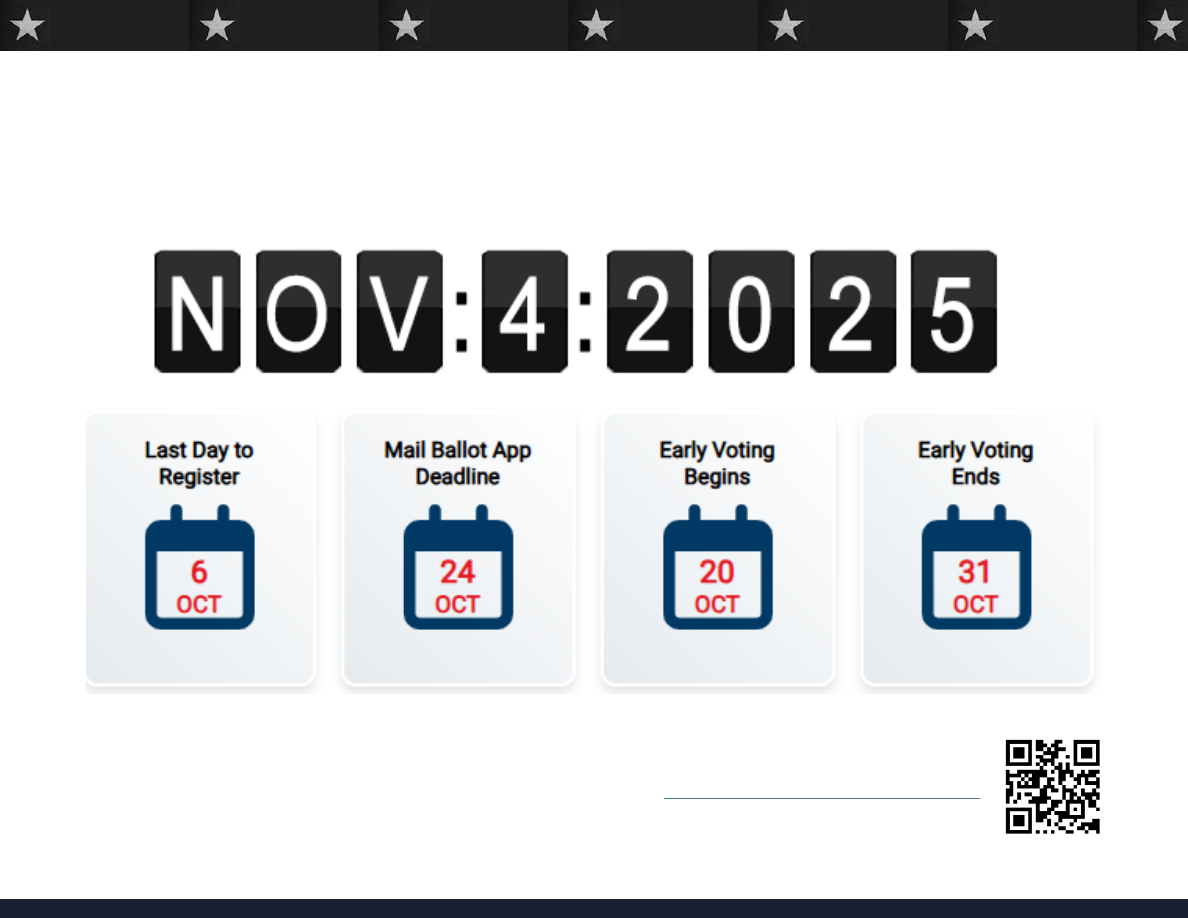

Texas Constitutional Amendments Voting Information

//https:%%//%%www.votetexas.gov///

ELECTION DAY

© 2025

13

2025

Constitutional Amendment

Propositions

In Order As They Will Appear On The Ballot

Bill Number: SJR59

Taxpayer Cost: $ 850 M

(Investment Fund Transfer)

Proposition 1

Ba

llo

t

W

or

ding

The constitutional amendment providing for the creation of the permanent technical institution infrastructure

fund and the available workforce education fund to support the capital needs of educational programs offered by

the Texas State Technical College System.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Birdwell

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

110

[ 47/63 ]

29

[ 11/18]

NO

16

[ 1/15 ]

2

[ 0/2 ]

NV

24

[14/10 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

82.7%

98.3%

R

D

Texas State Technical College (TSTC) was established in 1969 and is a public technical

college with 11 campuses. TSTC is governed by a board of regents with nine members

who are appointed by the governor for six-year terms. As of 2025, it offers associate

degrees and certificates in 48 programs across nine industries

—

allied health, aviation,

computer and information technology, construction and maintenance, engineering and

manufacturing, environmental and safety, hospitality, online programs, and transportation.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 7

Add section(s): 21

Delete section(s):

Amend section(s): 17, 18

Full Resolution

Text

CONSTITUTIONAL HISTORY

Article 7, Section 17 was added to the Texas Constitution in 1984 with the approval of

Proposition 2 with 71.9% of voters supporting it. It authorized dedicated funding for 26

institutions of higher education. Section 17 requires the first $100 million collected by the

state that is not otherwise appropriated to be allocated to these institutions for capital

improvements. The amendment also authorized the legislature to change the

constitutionally required appropriation for the next five fiscal years by a two-thirds

supermajority vote of state legislators. Texas State Technical College (TSTC) was added

to the list of eligible institutions with the approval of Proposition 13 in 1993. It was

approved by a margin of 58.2% to 41.8%.

Proposition 1 would create the Available Fund or the Available Workforce Education Fund

and the Permanent Fund or the Permanent Technical Institution Infrastructure Fund as

special funds in the state treasury separate from the general fund to provide a dedicated \\ revenue source for capital projects and equipment purchases for the Texas State

Technical College System. These Funds will be seeded with an initial $850 million from

general revenue. The state Comptroller would be responsible for managing the funds..

© 2025

14

© 2025

15

Bill Number: SJR18

Proposition 1

STATEMENT OF INTENT / ANALYSIS

Texas State Technical College (TSTC) historically has been underfunded, with no consistently adequate capital funding to allow for strategic growth in

current or new campuses. With the record growth of employment rates in Texas, the skilled-labor shortage also continues to grow. TSTC has a long

history of proven performance in training highly skilled workers. This is why a large group of associations and businesses have been pushing for the

expansion of TSTC into the fastest growing regions of Texas for access to training facilities that produce the skilled workforce needed. S.J.R. 59

creates a reliable source of capital funding for TSTC to expand technical training in order to meet the growing skills gap in Texas and place more

Texans in great-paying jobs. S.J.R. 59 establishes a constitutionally dedicated, permanent endowment to fund the capital infrastructure needs of

career and technical education programs offered by TSTC.

POSITIONS

FAVOR

OPPOSE

Texas 2036, Texas Association of Manufacturers, Texas

Association of Builders, AGC-Texas Building Branch, Texas

Economic Development Council, Texas Recreational Vehicle

Association, Texas Trucking Association, Association of

Equipment Manufacturers, NFIB, Texas Construction Association,

Associated Builders and Contractors of Texas, Inc, Texas

Realtors, BASF Corporation, North Texas Commission, Texas

Chemistry Council, Advanced Power Alliance, Samsung Austin

Semiconductor, LLC., Dallas Regional Chamber, Texas

Solar+Storage Association, Lumbermen's Association of Texas

Texas Policy Research

“This legislation will be vital in ensuring that Texas has the

skilled workforce needed to meet the demands of our

booming economy!“ –

State Rep. Stan Lambert (R-71)

“While expanding access to workforce education supports

individual liberty and personal responsibility, embedding

this preferential funding mechanism in the Constitution

undermines limited government and transparency. A

statutory approach with normal budget oversight would

better uphold fiscal accountability.”

A

“Yes”

Vote supports the use of $850 million to establish these two special funds outside of the general revenue

fund to support the capital needs of the Texas Technical College System.

A

“No”

Vote opposes the use of $850 million to establish these two special funds outside of the general revenue

fund to support the capital needs of the Texas Technical College System.

Taxpayer Cost: $ 850 M

(Investment Fund Transfer)

Bill Number: SJR18

Proposition 2

Ba

llo

t

W

or

ding

The constitutional amendment prohibiting the imposition of a tax on the realized or unrealized capital gains of an

individual, family, estate, or trust.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Perry

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

104

[ 17/87 ]

25

[ 5/20]

NO

26

[ 26/0 ]

6

[ 6/0 ]

NV

20

[19/1 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

100.0%

40.7%

R

D

For tax year 2024, 42 states taxed capital gains. The highest rate for each state ranged

from 2.5% in Arizona to 14.4% in California. Eight states, including Texas, do not tax

capital gains. No state has enacted a tax on unrealized capital gains. California, Illinois,

New York, Vermont, and Washington have considered legislation that proposed taxing

unrealized capital gains.

The federal government taxes capital gains according to how long they were held by the

taxpayer. Short-term capital gains apply to capital assets held for less than a year, while

long-term capital gains apply to capital assets held for more than one year. Short-term

capital gains are taxed as regular income at the rate that applies to the taxpayer's income

bracket. Long-term capital gains are taxed according to filing status and income bracket..

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s): 24-b

Delete section(s):

Amend section(s):

Full Resolution

Text

CONSTITUTIONAL HISTORY

Article 8 has been amended 3 times since 1993. In 1993 and 2019voters approved

prohibiting a personal income tax with 69% and 74% respectively. In 2023, voters

approved the prohibition of a wealth or net worth tax with 68%.

The amendment would amend Article 8 of the Texas Constitution to prohibit the Texas

State Legislature from imposing a tax on realized or unrealized capital gains of an

individual, family, estate, or trust, including a tax on the sale or transfer of the capital

asset.

A capital asset is property held for personal investment, like stocks, bonds, real estate,

and personal vehicles. Realized gains are the profits an individual makes from selling that

investment. In contrast, unrealized gains represent the potential profit an individual could

make if they were to sell an investment at its current market value.

The amendment would also add language stating that the prohibition would not apply to

ad valorem taxes on property, sales taxes on goods and services, or a use tax on the

storage, use, or other consumption of goods and services within the state.

© 2025

16

Taxpayer Cost: $ 344 K (’26)

($152 K Annually) See Fiscal Note @ TLO

© 2025

17

Bill Number: SJR18

Proposition 2

STATEMENT OF INTENT / ANALYSIS

Currently, several states do not have a state income tax, including Texas. Although state law in the State of Washington prohibits the state from

adopting an income tax, the Washington Legislature successfully enacted a capital gains tax that has survived court challenges. Many Texans were

previously reassured that Texas would not be able to enact a capital gains tax because the state has a constitutional amendment barring the

establishment of an income tax. However, after this recent development in the State of Washington and discussions in Congress about taxing

unrealized capital gains, many Texans are concerned that a future legislature could enact a capital gains tax. This constitutional amendment would

prohibit Texas from ever enacting a capital gains tax on realized or unrealized capital gains of an individual, family, estate, or trust. This amendment

will ensure Texas remains a tax friendly state. S.J.R. 18 proposes a constitutional amendment prohibiting the imposition of a tax on the realized

or unrealized capital gains of an individual, family, estate, or trust.

POSITIONS

FAVOR

OPPOSE

Texas Fram Bureau, Texas Policy Research

“This measure upholds individual liberty, private property

rights, and free enterprise by protecting Texans from future

financial intrusion and double taxation. It strengthens

Texas’s commitment to limited government and long

-term

economic competitiveness.”

- Texas Policy Research

A

“Yes”

Vote supports the prohibition of the state legislature from enacting a tax on realized or unrealized capital

gains of an individual, family, estate, or trust, including a tax on the sale or transfer of a capital asset.

A

“No”

Vote opposes the prohibition of the state legislature from enacting a tax on realized or unrealized capital

gains of an individual, family, estate, or trust, including a tax on the sale or transfer of a capital asset.

Taxpayer Cost: $ 344 K (’26)

($152 K Annually) See Fiscal Note @ TLO

Bill Number: SJR5

Proposition 3

Ba

llo

t

W

or

ding

The constitutional amendment requiring the denial of bail under certain circumstances to persons accused of

certain offenses punishable as a felony.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Huffman

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

133

[ 46/87 ]

31

[ 11/20]

NO

8

[ 8/0 ]

0

[ 0/0 ]

NV

9

[8/1 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

100.0%

87.7%

R

D

Bail is an amount of money a defendant must pay in order to be released from custody while

awaiting their trial. Bail is an assurance that the defendant will attend all required trials. Bail is

returned to the defendant after a trial is over. A judge or magistrate determines a proper bail amount

to set for a defendant based on their criminal history, prior court appearances, community ties, risk

to the community and law enforcement, and likelihood of appearance in court.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 1

Add section(s): 11-d

Delete section(s):

Amend section(s):

Full Resolution

Text

CONSTITUTIONAL HISTORY

Texas voters have decided on five constitutional amendments related to denying bail.

Each was approved with at least 79% of the vote.

Proposition 3 would propose a constitutional amendment to require that bail be denied pending trial to

a person accused of one or more of the following felony offenses if the state demonstrated by clear

and convincing evidence after a hearing that granting bail would have been insufficient to reasonably

prevent the person’s willful nonappearance in court or ensure the safety of the community, law

enforcement, and victim of the alleged offense: murder; capital murder; aggravated assault if the

person caused serious bodily injury or used a firearm, club, knife, or explosive weapon; aggravated

kidnapping; aggravated robbery; aggravated sexual assault; indecency with a child; trafficking of

persons; or continuous trafficking of persons.

© 2025

18

Taxpayer Cost: Undetermined

See Fiscal Note @ TLO

Section 11 of Article 1 of the Texas Constitution guarantees all prisoners the right to bail

with the following exceptions: capital offenses, an accused who has twice been convicted \\ of a felony, an accused who has committed a felony while on bail for a prior felony they

were indicted for, a person accused of a felony with a deadly weapon after being

convicted of a prior felony, or a person accused of a violent or sexual offense committed while under

the supervision of a criminal justice agency of the State or a political subdivision of the State for a

prior felony.

The constitution also currently authorizes judges or magistrates to deny bail following a hearing if the

offender is accused of a felony or an offense involving family violence and is released on bail

pending trial, and whose bail is subsequently revoked or forfeited for violating the conditions of

release.

© 2025

19

Bill Number: SJR5

Proposition 3

STATEMENT OF INTENT / ANALYSIS

,

The current options for denying bail pending trial effectively require a full trial on the merits at the time bail is denied, or shortly thereafter. This leads

to rare utilization, even in the most appropriate situations to ensure public safety. Currently, magistrates may only deny bail under very limited

circumstances. This means defendants accused of most crimes, including murder, must be released if they have the money to post bond, even if

there is clear and convincing evidence that the individual may commit future violent crimes. Specifically, this amendment would give magistrates the

ability to deny bail to individuals accused of committing: (1) a sexual offense punishable as a felony of the first degree; (2) a violent offense as

defined by the Texas Constitution; or (3) continuous trafficking of persons. For bail to be denied for one of these offenses, a judge or magistrate

must determine by clear and convincing evidence that the denial of bail is necessary to ensure either: the person's appearance in court; or the safety

of the community, law enforcement, or the victim of the alleged offense. A judge or magistrate who denies bail would be required to issue a written

order laying out their findings of fact and explaining why the denial of bail is necessary.

POSITIONS

FAVOR

OPPOSE

Crime Stoppers, TPPF, TMPA, Austin Police Assoc., The

Professional Bondsman of Texas, HRBC, Sheriff’s Assoc. of

Texas, FOP 39, HPOU, SAPOA, TGWPOA, SAPD, DPA, City of

Houston, Upbring, CLEAT, Texas Police Chief’s Assoc.,

“This historic vote shows that the Texas House has decided

to put public safety above party politics. This collaboration

will undeniably make Texas stronger and our communities

safer.” - Nikki Pressley, Texas state director of Right on Crime

at the Texas Public Policy Foundation

A

“Yes”

Vote supports the denial bail to individuals accused of certain violent or sexual offenses punishable as a

felony.

A

“No”

Vote opposes the denial bail to individuals accused of certain violent or sexual offenses punishable as a

felony.

Texas Civil Rights Project, American Civil Liberties Union of

Texas, Texas Jail Project, The Bail Project, LatinoJustice

PRLDEF, Texas Criminal Defense Lawyers Association, Vera

Institute of Justice, Texas Policy Research

“While aimed at improving public safety, this amendment

undermines individual liberty by expanding pretrial detention

without conviction and curtails judicial discretion. It creates

a rigid, constitutionally enshrined mandate that risks

overreach, erodes due process, and expands the scope of

government authority without adequate safeguards.” –

Texas

Research Project

Taxpayer Cost: Undetermined

See Fiscal Note @ TLO

Bill Number: HJR7

Proposition 4

Ba

llo

t

W

or

ding

The constitutional amendment to dedicate a portion of the revenue derived from state sales and use taxes to the

Texas water fund and to provide for the allocation and use of that revenue.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Harris|Hunter|Martinez|Kitzman|Metcalf

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

134

[ 52/70 ]

31

[ 11/20]

NO

12

[ 0/12 ]

0

[ 0/0 ]

NV

16

[10/6 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

88.2%

100.0%

R

D

The Texas Water Fund (TWF) is a special fund in the state treasury outside of the general fund. Money \\ in the fund can only be transferred to the Water Assistance Fund, the New Supply Fund, the Water

Implementation Fund, the State Water Implementation Revenue Fund for Texas, the Financial

Assistance for Water Pollution Control, Rural Water Assistance Fund, the state Water Account, the

Financial Assistance Account, and the state Participation Account. Distributions to water infrastructure \\ projects will prioritize projects in rural political subdivisions or municipalities with a population of less

than 150,000.

TWF is administered by the Texas Water Development Board (WDB). The fund received a one-time

appropriation of $1 billion in 2023 through the supplemental appropriations bill (Senate Bill 30) and an \\ additional $2.5 billion from the latest supplemental budget passed during the 2025 regular legislative

session (House Bill 500). The WDB oversees state programs related to the conservation and

development of water resources in Texas.

The implementing legislation is SB7 which was passed during the 2025 regular session.

The latest state water plan, published by the TWD was released in 2022 and show totals by decade

from 2020 to 2070. As of 2025, the state sales tax rate was 6.25% with local jurisdictions with an

additional levy of up to 2%. Sales tax revenues from 2014 to 2024 are included in the Texas

Comptroller's report “Sources of Revenue” (July 2025)

TEXAS CONSTITUTION IMPACT(S)

Article(s): 3, 8

Add section(s):

Delete section(s):

Amend section(s): 49-d-16, 7-e

Full Resolution

Text

CONSTITUTIONAL HISTORY

The Texas Water Fund (TWF) was established with the approval of Proposition 6 in 2023 by 77.7%

of voters. The Texas Water Development Board (WDB) was created in 1957 with the passage of

Proposition 2 with 74% of voters.

Proposition 4 would amend the Texas Constitution to authorize the Texas State Legislature to require the comptroller to

annually allocate the first $1 billion in net sales tax revenue after revenue exceeds $46.5 billion to the Texas Water Fund.

The comptroller's authority to allocate the first $1 billion would expire on August 31, 2047.

© 2025

20

Taxpayer Cost: $ 1 B (

per annum

)

(2028 - 2047) See Fiscal Note @ TLO

The allocation would be administered in a separate account in the fund, and the amendment would prohibit

the use of the funds unless an appropriation law is passed. The amendment would also prohibit the state

legislature from changing the law that requires the allocation for the first 10 years. If a state of disaster is

declared, the allocation may be suspended through either the regular budget process or a concurrent

resolution approved by a majority of state legislators. Proposition 4 would prohibit the transfer of sales tax \\ revenue allocated to the Texas Water Fund to the New Water Supply for Texas Fund for financing

groundwater infrastructure projects. The amendment would take effect on September 1, 2027.

© 2025

21

Bill Number: HJR7

Proposition 4

STATEMENT OF INTENT / ANALYSIS

,

Texas is facing a severe long-term water supply deficit and significant funding shortfall for all types of water-related infrastructure. By 2070, the 2022 Texas State Water

Plan (SWP) projects a water supply shortfall of up to 6.86 million acre-feet annually. Taken together, the accelerating rates of population growth and economic

development and the increasing drought severity and frequency experienced in Texas since the 2022 iteration of the SWP was published three years ago suggest that

projected shortfall is actually underestimated. Extrapolating from the consequences of the 2011 drought, a report commissioned in 2024 by Texas 2036 found that the

Texas economy could lose approximately 785,000 jobs and suffer $160 billion in lost gross domestic product (GDP) by the end of the 2030s attributable to water scarcity

if left unaddressed. The report found that the Texas power grid is acutely susceptible to water scarcity; 82,100 megawatts, or 53.9 percent, of the current Texas power

generation capacity relies on significant volumes of water for steam generation and/or cooling. During testimony, before the SWARA Committee in February 2025, the

Texas Water Development Board estimated projected funding needs of approximately $8 billion for water treatment projects, $54.5 billion for flood infrastructure projects,

and $80 billion for SWP projects. In its report, Texas 2036 estimated $153.8 billion in total water-related financial assistance needs over the next 50 years. As engrossed,

H.J.R. 7 satisfies Governor Abbott's emergency request by constitutionally dedicating $1billion in sales and use tax revenues to the Texas Water Funding each state fiscal

year beginning with FY 2028. As substituted, H.J.R. 7 satisfies the SWARA Committee recommendation by allocating 80 percent of the funding for NWSTF projects during

the initial term of the dedication.

POSITIONS

//** **//

//** **//

FAVOR

OPPOSE

Texas Assoc. of Manufacturers, The Nature Conservancy in TX, TXWIN,

Texas Water Supply Partners, Texas Water Association, Greater Houston

Partnership, Texas 2036, Lower Colorado River Authority, Brazos River

Authority, EDF, National Wildlife Federation, AGC of Texas, Texas Assoc.

of Business, Texas Farm Bureau, Texas Realtors, Texas Rural Water

Assoc., Texas Oil & Gas Assoc., GBRA, …more

“Texas 2036 projects that the state will need to invest at least $154

billion in the coming decades toward expanding our water supply

portfolio and fixing aging, deteriorating systems. We estimate that

existing state and federal funding programs will cover roughly 25% of

this need. This will leave a long-term water infrastructure funding

gap of $110 billion. HJR 7 addresses this problem, in part, with its $1

billion per year revenue dedication to the Texas Water Fund.“ –

Texas

2036

A

“Yes”

Vote supports allocation of the first $1 billion per fiscal year of sales tax revenue after it exceeds $46.5

billion to the state water fund and authorize the state legislature, by a two-thirds vote, to adjust the amount allocated.

A

“No”

Vote opposes allocation of the first $1 billion per fiscal year of sales tax revenue after it exceeds $46.5 billion

to the state water fund and authorize the state legislature, by a two-thirds vote, to adjust the amount allocated.

Texas Policy Research

HJR 7 would not provide sufficient funding to secure the state’s water

future given the size of projected water funding needs. As such, the

resolution should not allow the Legislature to reduce the annual

funding by concurrent resolution.

In addition, the resolution should explicitly dedicate part of the annual

funding to new water supply development. Without new water supply

investments, the state risks overdependence and possible depletion

of groundwater resources due to water exports from rural areas to

urban centers.

Taxpayer Cost: $ 1 B (

per annum

)

(2028 - 2047)

See Fiscal Note @ TLO

Bill Number: HJR99

Proposition 5

Ba

llo

t

W

or

ding

The constitutional amendment authorizing the legislature to exempt from ad valorem taxation tangible personal

property consisting of animal feed held by the owner of the property for sale at retail.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Harris

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

102

[ 17/85 ]

30

[ 10/20]

NO

5

[ 4/1 ]

1

[ 1/0 ]

NV

43

[41/2 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

99.1%

84.4%

R

D

In 1968, Texas voters adopted Proposition 7, which provided for a gradual reduction in

the state property tax and eventual abolishment after 1978, with exceptions for certain

institutions of higher learning. In 1982, this exception for certain higher education

institutions to levy state ad valorem property taxes was repealed with the passage of

Proposition 1. As of 2025, only local taxing units, cities, counties, school districts, junior

colleges, and special districts levy ad valorem taxes.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s): 1-s

Delete section(s):

Amend section(s):

Full Resolution

Text

CONSTITUTIONAL HISTORY

Adding a new section to Article 8.

HJR 99 proposes a constitutional amendment to allow the legislature to exempt animal

feed held by the owner for retail sale from ad valorem taxation. The proposed

amendment would authorize the legislature to provide additional eligibility requirements

for the exemption.

© 2025

22

Taxpayer Cost: Undetermined

See Fiscal Note @ TLO

© 2025

23

Bill Number: HJR99

Proposition 5

STATEMENT OF INTENT / ANALYSIS

,

H.J.R. 99 proposes a constitutional amendment authorizing the legislature to exempt from ad valorem taxation tangible personal property consisting of animal feed

held by the owner of the property for sale at retail.

POSITIONS

//** **//

//** **//

FAVOR

OPPOSE

Texas Farm Bureau, Colony Ranch Supply, Inc., Texas Policy Research,

Individual

“By reducing a targeted tax burden on agricultural retailers, this

measure promotes free enterprise and strengthens private property

rights. Though exemptions should be used cautiously, this

permissive amendment gives the Legislature flexibility to deliver

fairer tax treatment without mandating new spending.“ –

Texas

Policy Research

A

“Yes”

Vote supports authorizing the state legislature to pass a property tax exemption on animal feed held by the

property owner for retail sale.

A

“No”

Vote opposes authorizing the state legislature to pass a property tax exemption on animal feed held by the

property owner for retail sale.

Individuals

Taxpayer Cost: Undetermined

See Fiscal Note @ TLO

Bill Number: HJR4

Proposition 6

Ba

llo

t

W

or

ding

The constitutional amendment prohibiting the legislature from enacting a law imposing an occupation tax on

certain entities that enter into transactions conveying securities or imposing a tax on certain securities

transactions.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Meyer|Button|Vasut|Moody|Anchia

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

111

[ 28/83 ]

28

[ 8/20]

NO

31

[ 27/4 ]

3

[ 3/0]

NV

8

[7/1 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

96.3%

54.5%

R

D

In January 2025, a group led by Texas Stock Exchange CEO James Lee and financed by institutional

investors, including Charles Schwab, Fortress, BlackRock, and Citadel Securities, announced plans

to file and begin operating a national stock exchange headquartered in Dallas, Texas, starting in

2026. The exchange would facilitate listings of public companies, exchange-traded products (ETPs),

and American depositary receipts (ADRs). The U.S. has 13 stock market exchanges as of 2025.

New York had a financial transaction tax from 1905 to 1981, when the New York Stock Exchange

considered leaving the state due to the tax. The tax is still in state law, but the state now offers a

100% rebate on the tax, effectively making it null. A bill by State Rep. Phil Steck (D-110) proposed

during the 2019-2020 legislative session would have repealed the rebate and taxed the sale of a

stock between $0.0125 and $0.05, depending on the value of the stock being sold. Rep. Steck

pointed to international exchanges that have similar taxes, saying, ”Every single significant exchange

in the world has a financial transaction tax save one, which is Germany, and they've proposed it

there.During the 2020-2021 legislative session, the New Jersey State Legislature proposed

Assembly Bill 4402, which proposed imposing a tax on high-quantity processors of financial

transactions at $0.0025 per transaction. The bill was referred to the Assembly Financial Institutions

and Insurance Committee, but it did not receive a vote by either chamber.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s): 30

Delete section(s):

Amend section(s):

Full Resolution

Text

CONSTITUTIONAL HISTORY

Since 1993, Texas voters have decided on three amendments to prohibit future taxes by adding the

prohibitions to the state constitution. All three were approved. In 2025, voters will decide on three

amendments to prohibit future taxes. 2023: Proposition 3 to Prohibit a wealth or net worth tax, 2019:

Proposition 4 to prohibit the state from levying an income tax on individuals, and 1993:Proposition 4

to prohibit personal income tax without voter approval, directing revenue to education and limiting

local school tax rules. Each was approved by 68%, 74% and 69% respectively.

© 2025

24

Taxpayer Cost: $ 0

a constitutional amendment to prohibit the legislature from enacting a law that

imposes an occupation tax on a registered securities market operator or a tax on a securities transaction

conducted by a registered securities market operator. The proposed amendment would not prohibit the

imposition of a general business tax measured by business activity, a tax on the production of minerals, a

tax on insurance premiums, a sales and use tax on tangible personal property or services, or a fee based

on the cost of processing or creating documents. The proposed amendment would also not prohibit a

change in the rate of a tax in existence on January 1, 2026.

© 2025

25

Bill Number: HJR4

Proposition 6

STATEMENT OF INTENT / ANALYSIS

,

During the COVID-19 pandemic, New York and New Jersey proposed financial transaction taxes, prompting concerns about retirement investments

and causing New York and Nasdaq to consider relocating to Texas. With many individuals relying on 401(k)s, IRAs, and pensions for retirement,

concerns arose that such a tax could reduce returns and hinder savings. Though both states abandoned the proposals, the risk remains. With Texas'

development of a fully integrated stock exchange, H.J.R. 4 proposes a constitutional amendment to ban new taxes on securities transfers and

financial transactions, protecting Texans and businesses. H.J.R. 4 proposes a constitutional amendment prohibiting the enactment of a law imposing

an occupation tax on certain entities that enter into transactions conveying securities or imposing a tax on certain securities transactions.

POSITIONS

//** **//

//** **//

FAVOR

OPPOSE

Texas Stock Exchange (TXSE), Texas Policy Research

“This measure affirms limited government, free enterprise, and

private property rights by protecting investment activity from

targeted taxation. It preserves Texas’s pro

-business climate without

fiscal downside, safeguarding both institutional and individual

investors from government interference.” –

Texas Policy Research

A

“Yes”

Vote supports the prohibition of laws that impose an occupation tax on a registered securities market

operator or a securities transaction tax.

A

“No”

Vote opposes the prohibition of laws that impose an occupation tax on a registered securities market

operator or a securities transaction tax.

True Texas Project, Individual

Taxpayer Cost: $ 0

Bill Number: HJR133

Proposition 7

Ba

llo

t

W

or

ding

The constitutional amendment authorizing the legislature to provide for an exemption from ad valorem taxation

of all or part of the market value of the residence homestead of the surviving spouse of a veteran who died as a

result of a condition or disease that is presumed under federal law to have been service-connected.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Turner|Button|Cook|Cortez|Garcia L.

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

111

[ 28/83 ]

28

[ 8/20]

NO

31

[ 27/4 ]

3

[ 3/0]

NV

8

[7/1 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

96.3%

54.5%

R

D

A homestead property tax exemption reduces the taxable value of a residence. The taxable value

can either be the market value or the property's assessed value. Market value is the price at

which the property would be sold. Assessed value is calculated by applying an assessment ratio

to the market value.

House Bill 2508 (HB 2508) is the implementing legislation for the amendment, and it was also

passed during the 2025 legislative session. It will take effect if Proposition 7 is approved. HB

2508 authorizes a property tax exemption for the total appraised value of the homestead of a

surviving spouse of a veteran killed by a service-connected disease, regardless of disability

status at the time of death. The surviving spouse would qualify for the exemption as long as

they have not remarried and the service-connected disease is a qualifying condition or disease

under the Sergeant First Class Heath Robinson Honoring our Promise to Address

Comprehensive Toxics Act of 2022, also known as the PACT Act. A surviving spouse would also

be able to receive a homestead property tax exemption on a new property in an amount equal to

the dollar amount of the exemption on the first property if the surviving spouse has not

remarried.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s): 30

Delete section(s):

Amend section(s):

Full Resolution

Text

CONSTITUTIONAL HISTORY

Between 1972 and 2021, Texas voters decided on eight constitutional amendments

related to tax exemptions for veterans. All eight were approved with at least 69% of the

vote.

© 2025

26

HJR 133 proposes a constitutional amendment to allow the legislature to give surviving

spouses of United States armed services veterans a property tax exemption on their

residence homestead. The proposed amendment would exempt all or part of the

property tax on the spouse’s residence homestead if the veteran died from a condition

or disease presumed under federal law to be service-related. The exemption would

apply only to a surviving spouse who has not remarried since the veteran’s death.

Taxpayer Cost: Undetermined

See Fiscal Note @ TLO for Local Implications

© 2025

27

Bill Number: HJR133

Proposition 7

STATEMENT OF INTENT / ANALYSIS

According to a 2024 study on veterans in Texas prepared by the Texas Workforce Investment Council, approximately 1.5 million individuals 18 years

of age and older in Texas were veterans in 2021. Current state law entitles a veteran who is rated as 100 percent disabled due to a service connected

disability to an exemption from property taxation of the total appraised value of the veteran's residence homestead, and when a 100 percent disabled

veteran passes away, a qualifying surviving spouse is entitled to the same residence homestead exemption for the property to which the veteran's

exemption applied. However, the resolution author has informed the committee that a gap exists in current law with respect to veterans who pass

away due to a condition or disease for which the federal Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive

Toxics (PACT) Act of 2022 establishes a presumption of service connection but who are not yet rated as 100 percent disabled at the time of the

veteran’s death, in which case the surviving spouse is not entitled to a residence homestead exemption. H.J.R. 133 seeks to

address this issue by

authorizing the legislature to entitle the surviving spouse of a veteran who died as a result of a qualifying condition or disease presumed under

federal law to have been service-connected to certain exemptions from property taxation.

POSITIONS

//** **//

//** **//

FAVOR

OPPOSE

The American Legion Dept of Texas, Texas Policy Research

“This measure honors the sacrifices of military families and protects

individual liberty and property rights. While further exemptions

complicate the tax system, this narrowly targeted relief is justified. It

should, however, be accompanied by broader property tax reform to

maintain equity and simplicity.” –

Texas Policy Research

A

“Yes”

Vote supports authorizing the state legislature to establish a property tax exemption on all or part of the

market value of the homestead of a surviving spouse of a veteran who died from a service-connected disease.

A

“No”

Vote opposes authorizing the state legislature to establish a property tax exemption on all or part of the

market value of the homestead of a surviving spouse of a veteran who died from a service-connected disease.

Taxpayer Cost: Undetermined

See Fiscal Note @ TLO for Local Implications

Bill Number: HJR2

Proposition 8

Ba

llo

t

W

or

ding

The constitutional amendment to prohibit the legislature from imposing death taxes applicable to a decedent's

property or the transfer of an estate, inheritance, legacy, succession, or gift.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Turner|Button|Cook|Cortez|Garcia L.

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

112

[ 25/87 ]

27

[ 7/20]

NO

29

[ 29/0 ]

3

[ 3/0]

NV

9

[8/1 ]

1

[ 1/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

100.0%

50.0%

R

D

An estate tax is a tax levied on the total value of a deceased person's property that is being

transferred to their heirs, which means that it is paid by the estate and not the heirs. An inheritance

tax is a tax levied on the assets received by an heir, so it is paid by the heir. Texas currently does

not have an estate or an inheritance tax.

For tax year 2024, 12 states imposed an estate tax, six states imposed an inheritance tax, and one

state

—

Maryland

—

imposed both an estate and an inheritance tax. The majority of estate and

inheritance taxes levied by states are progressive, meaning the tax rate increases as the value of

taxable assets increases. The states with the highest marginal rates are Hawaii and Washington, at

rates of 20% for estates valued at $15.49 million and $9 million, respectively. Kentucky and New

Jersey have the highest marginal inheritance tax rates of 16%

During the 2015 legislative session, the Texas State Legislature passed Senate Bill 752 (SB 752)

repealing the state's inheritance tax. The state tax was initially structured to equal the federal estate

tax credit for estate taxes collected by the states. However, with changes to the federal tax

structure, including the elimination of the credit in 2005, Texas estate tax revenue became zero. SB

752 also repealed the tax on combative sports events, like boxing, kickboxing, and mixed martial

arts.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s): 26

Delete section(s):

Amend section(s):

Full Resolution

Text

CONSTITUTIONAL HISTORY

Since 1993, Texas voters have decided on three amendments to prohibit future taxes by adding the

prohibitions to the state constitution. All three were approved by 68% or greater. In 2025, voters will

decide on three amendments to prohibit future taxes(Propositions 2, 6, 8).

© 2025

28

HJR 2 proposes a constitutional amendment to prohibit the legislature from imposing a state tax on a

deceased individual’s estate because of the individual’s death, including an estate, inheritance, or death

tax. The proposed amendment would prohibit the legislature from imposing a state tax on the transfer of

an estate, inheritance, legacy, succession, or gift from an individual, family, estate, or trust, including

generation-skipping transfers, if the tax was not in effect on January 1, 2025. The proposed amendment

would also prohibit the legislature from increasing the tax rate or expanding the applicability to new

parties of a transfer tax that was in effect on January 1, 2025. The proposed amendment would not

prohibit the imposition or change in the rate or applicability of a general business tax measured by

business activity; a tax on the production of minerals; a tax on the issuance of title insurance; a tax in

existence on January 1, 2016; a tax on the transfer of a motor vehicle by gift; or an ad valorem tax on

property.

Taxpayer Cost: $0

© 2025

29

Bill Number: HJR2

Proposition 8

STATEMENT OF INTENT / ANALYSIS

Texas used to collect a Death Tax, but the 84th Legislature passed S.B. 752 effectively repealing Texas' version of the Death Tax. There are a number

of states that have enacted a variety of property transfer taxes including, estate, inheritance, and gift taxes. Texans are now concerned that future

legislatures could revive the Death Tax or institute other types of property transfer taxes in the years to come. This constitutional amendment would

prohibit Texas from enacting a death, estate, inheritance, legacy, succession, gift, or generation-skipping transfer tax on an individual, family, estate,

or trust. H.J.R. 2 proposes a constitutional amendment prohibiting the legislature from imposing death taxes applicable to a decedent's property or

the transfer of an estate, inheritance, legacy, succession, or gift.

POSITIONS

//** **//

//** **//

FAVOR

OPPOSE

Texas Farm Bureau, Texas Association of Builders, Texas Policy

Research

HJR 2 would ensure that no death tax could be imposed in Texas by

creating a constitutional prohibition, which would help guarantee

that heirs and beneficiaries could continue to retain property and

assets after the passing of a loved one. Death taxes can be

burdensome and could lead to estate-planning and tax-avoidance

strategies that are inefficient. The money that a person leaves at

their death has already been taxed once, and the government should

be limited in the number of times it can tax the same assets.

Although Texas does not currently have a death tax, HJR 2 would

ensure that future legislatures could not institute one.

A

“Yes”

Vote supports prohibiting the state legislature from imposing a tax on a decedent’s property or the transfer

of an estate, inheritance, legacy, succession, or gift.

A

“No”

Vote opposes prohibiting the state legislature from imposing a tax on a decedent’s property or the transfer of

an estate, inheritance, legacy, succession, or gift.

True Texas Project

Amending the state Constitution to prohibit a death tax that does not

currently exist could hinder future legislatures from acting in the best

interest of the state and lead to unintended consequences.

Constitutional amendments should be reserved for the most critical

matters concerning the state, and there is currently no proposal in the

Legislature to institute a death tax.

Taxpayer Cost: Undetermined

Bill Number: HJR1

Proposition 9

Ba

llo

t

W

or

ding

The constitutional amendment to authorize the legislature to exempt from ad valorem taxation a portion of the

market value of tangible personal property a person owns that is held or used for the production of income.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Meyer|Bonnen|Button|Martinez Fischer|Bernal

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

112

[ 39/73 ]

31

[ 11/20]

NO

13

[ 8/5 ]

0

[ 0/0]

NV

25

[15/10 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

94.9%

86.2%

R

D

House Bill 9, the implementing legislation for Proposition 9, was passed during the 2025

legislative session. It would take effect on January 1, 2026, if Proposition 9 is approved.

HB 9 would authorize the $125,000 property exemption for tangible personal property

used for income production in the state tax code. It would repeal the existing exemption

of less than $2,500 in taxable value. The exemption could be claimed in each location in

a taxing unit where the property is held or used. HB 9 would also require all taxable

property located in separate areas but within the same taxing jurisdiction to be

combined to determine the total taxable value. A person who owns personal tangible

property for the production of income would be entitled to the exemption regardless of

whether the property is held at a leased location within the taxing jurisdiction. The bill

would also require a person to render tangible personal property owned or held for the

production of income if the total market value of the property is greater than the

exempted amount.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s):

Delete section(s):

Amend section(s): 1(g)

Full Resolution

Text

CONSTITUTIONAL HISTORY

The original property tax exemption for tangible property used for income production

was added to the Texas Constitution in 1995. Proposition 12 was approved with 70% of

the vote. It added subsections (g) and (h) to the constitution, which authorized property

tax exemptions for property used for income production and mineral interest if its

taxable value was less than the minimum amount needed to cover the tax administration

costs of the property.

© 2025

30

HJR 1 proposes a constitutional amendment to change the amount of tangible personal

property held or used for the production of income that the legislature could exempt

from property taxes to $125,000 rather than the minimum amount sufficient to recover

the costs of property tax administration.

Taxpayer Cost: $ 2.3 B

(2027 - 2030) See Fiscal Note @ TLO

© 2025

31

Bill Number: HJR1

Proposition 9

STATEMENT OF INTENT / ANALYSIS

H.J.R. 1 proposes a constitutional amendment to authorize the legislature to exempt from ad valorem taxation a portion of the market value of

tangible personal property a person owns that is held or used for the production of income.

The bill would provide definitions for “related business entity” and “unified business enterprise.” The chief appraiser would

have the right to

investigate whether an entity is a related business entity and has eligible aggregated tangible personal property. The bill would require a person to

render tangible personal property the person owns that is held or used for the production of income only if, in the person 's opinion, the aggregate

market value of the property having taxable situs in the same location in at least one taxing unit that participates in the appraisal district is greater

than the exempted amount. The bill would provide rendition requirements related to the tangible personal property that has taxable situs in an

appraisal district, the duration of certain rendition choices and renditions a chief appraiser can require.

POSITIONS

//** **//

//** **//

FAVOR

OPPOSE

Texas Hotel & Lodging Assoc., NFIB, Texas Farm Bureau, Texas

Association of Business, Texas Association of Property Tax

Professionals, Texas Apartment Assoc., AT&T, Huffines Liberty

foundation, Texas Taxpayers & Research Assoc., Texas Oil & Gas

Association Texas Chemistry Council, Texas Assoc. of

Manufacturers, Texas Realtors, Texas Retailers Assoc., Texas

Package Stores Assoc., LIBRE Initiative, Texas Restaurant Assoc.

HJR 1 and its enabling legislation, HB 9, would reduce the tax burden

on businesses, allowing them to reinvest these savings to expand their

operations. HJR 1 also would incentivize businesses to move to Texas

or remain in the state to take advantage of the exemption. In addition,

the resolution could reduce the need for businesses to move inventory

or equipment to avoid paying business personal property taxes on

these items.

A

“Yes”

Vote supports authorizing the state legislature to exempt $125,000 of the market value of personal tangible

property used for income production from taxes.

A

“No”

Vote opposes authorizing the state legislature to exempt $125,000 of the market value of personal tangible

property used for income production from taxes.

Harris County Commissioners Court, Travis County

Commissions Court

HJR 1 would negatively impact county and local government revenues.

Counties, municipalities, and special districts could have to raise tax

rates to cover the loss in property tax revenue from revising the

exemption, which could result in redistributing the property tax burden

to homeowners. HJR 1 could encourage business owners to avoid

taxes by creating new business entities or spreading inventory across

appraisal districts to take advantage of multiple business personal

property tax exemptions. Without methods to trace common

ownership or coordinate between appraisal districts, a taxing entity

would lack the mechanisms to ensure that each taxpayer only received

one exemption.

Taxpayer Cost: $ 2.3 B

(2027 - 2030) See Fiscal Note @ TLO

Bill Number: SJR84

Proposition 10

Ba

llo

t

W

or

ding

The constitutional amendment to authorize the legislature to provide for a temporary exemption from ad valorem

taxation of the appraised value of an improvement to a residence homestead that is completely destroyed by a

fire.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Bettencourt

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

129

[ 47/82 ]

31

[ 11/20]

NO

0

[ 0/0 ]

0

[ 0/0]

NV

21

[15/6 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

100.0%

100.0%

R

D

A homestead property tax exemption reduces the taxable value of a residence. The taxable value

can either be the market value or the property's assessed value. Market value is the price at

which the property would be sold. Assessed value is calculated by applying an assessment ratio

to the market value.

Senate Bill 467 (SB 467), the implementing legislation for Proposition 10, would authorize a

temporary property tax exemption on the appraised value of an improvement made to a qualifying \\ homestead. The homestead would need to meet the following qualifications:

completely destroyed by a fire; was a habitable dwelling immediately prior to the fire; and

is uninhabitable for at least 30 days after the date of the fire. The exempted amount would equal

the appraised value of the improvement multiplied by a ratio of the number of days remaining in

the tax year after the date on which the fire occurs out of 365 days. The person would qualify for

the exemption for the tax year in which the fire occurred and would be required to file an

application for the exemption with their respective appraisal district no later than 180 days after

the date of the fire. To determine whether the improvement qualifies under the bill, the chief

appraiser would be authorized to consult with any source they decide to be appropriate, such as a

county fire marshal or an insurance adjuster.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s):

Delete section(s):

Amend section(s): 1(b)

Full Resolution

Text

CONSTITUTIONAL HISTORY

Since 1997, Texans have approved four amendments to increase the homestead

property tax exemption. They were all approved with at least 83% of voters. The largest

increase was from $40,000 to $100,000 in 2023.

© 2025

32

SJR 84 proposes a constitutional amendment to allow the legislature to create a

temporary property tax exemption for the appraised value of an improvement to a

person’s residence homestead that is completely destroyed by a fire. The proposed

amendment authorizes the legislature to prescribe the duration of the exemption and to

establish additional eligibility requirements for the exemption.

Taxpayer Cost: Undetermined

See Fiscal Note @ TLO

© 2025

33

Bill Number: SJR84

Proposition 10

STATEMENT OF INTENT / ANALYSIS

S.J.R. 84 proposes a constitutional amendment to authorize the legislature to provide a temporary property tax exemption for a homestead property

damaged by fire. S.J.R. 84 is the constitutional amendment for S.B. 467. S.J.R. 84 proposes a constitutional amendment to authorize the legislature

to provide for a temporary exemption from ad valorem taxation of the appraised value of an improvement to a residence homestead that is

completely destroyed by a fire.

POSITIONS

FAVOR

OPPOSE

South Texans’ Property Rights Association, Texas Policy

Research

“Proposition 10 upholds individual liberty and private

property rights by ensuring homeowners are not taxed on

homes that no longer exist. It allows narrowly tailored,

compassionate relief without mandating new programs or

increasing government scope, consistent with limited

government principles.” –

Texas Policy Research

A

“Yes”

Vote supports authorizing the state legislature to provide a temporary homestead exemption for

improvements made to residences destroyed by fire.

A

“No”

Vote opposes authorizing the state legislature to provide a temporary homestead exemption for

improvements made to residences destroyed by fire.

Taxpayer Cost: $ 2.3 B

(2027 - 2030) See Fiscal Note @ TLO

Bill Number: SJR85

Proposition 11

Ba

llo

t

W

or

ding

The constitutional amendment authorizing the legislature to increase the amount of the exemption from ad

valorem taxation by a school district of the market value of the residence homestead of a person who is elderly

or disabled.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Bettencourt

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

145

[ 60/85 ]

31

[ 11/20]

NO

0

[ 0/0 ]

0

[ 0/0]

NV

5

[2/3 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

100.0%

100.0%

R

D

A homestead property tax exemption reduces the taxable value of a residence. The

taxable value can either be the market value or the property's assessed value. Market

value is the price at which the property would be sold. Assessed value is calculated by

applying an assessment ratio to the market value.

Senate Bill 23 (SB 23), the implementing legislation for Proposition 11, would increase

the homestead tax exemption for elderly and disabled residents from $10,000 to $60,000 \\ of the appraised value of the homestead. The bill would also provide funds to school

districts if the combined state and local revenue used to service existing debt does not

meet the minimum payment on eligible debt as of September 1, 2025, due to the

increase of the homestead exemption under the amendment. SB 23 would also authorize

the state to provide additional financial aid to school districts if the combined state and

local revenue used for maintenance and operations is less than the amount the district

would be entitled to if the exemption increase was not approved

TEXAS CONSTITUTION IMPACT(S)

Article(s): 8

Add section(s):

Delete section(s):

Amend section(s): 1(b)

Full Resolution

Text

CONSTITUTIONAL HISTORY

Since 2000, Texas voters have decided on and approved six constitutional amendments

related to property tax limits or exemptions for elderly or disabled persons or their

surviving spouses. Each was approved with at least 78% of voters supporting it. (2003:

Prop. 13 and 17, 2007: Prop. 1, 2015: Prop. 1, 2021: Prop 7, and 2022: Prop. 1)

© 2025

34

SJR 85 proposes a constitutional amendment to authorize the legislature to increase the

amount of the exemption from property taxation by a school district of the market value

of the residence homestead of a person who is 65 years of age or older or a person

who is disabled from $10,000 to $60,000.

Taxpayer Cost: $ 2.7 B

(2026

–

2030) See Fiscal Note @ TLO

© 2025

35

Bill Number: SJR85

Proposition 11

STATEMENT OF INTENT / ANALYSIS

S.J.R. 85 seeks to propose an amendment to the Texas Constitution to authorize the legislature to increase the additional homestead exemption for

over-65 and disabled homestead property owners from $10,000 to $60,000. S.J.R. 85 proposes a constitutional amendment authorizing the

legislature to increase the amount of the exemption from ad valorem taxation by a school district of the market value of the residence homestead of

a person who is elderly or disabled.

POSITIONS

//** **//

//** **//

FAVOR

OPPOSE

Texas Association of Builders, Texas Realtors, Texas Silver-

Haired Legislature, South Texans’ Property Rights Association

“By increasing the residence homestead property tax exemption

for individuals who are elderly and disabled, SJR 85 would increase

housing affordability and provide protection for a vulnerable

population. Many individuals who qualify for this exemption live on

a fixed income and face rising medical insurance costs. Individuals

who are elderly and disabled also often have to make expensive

modifications to their homes, such as adding ramps or

accessibility features to accommodate walkers, wheelchairs, and

other medical devices. Providing an increase in the homestead

exemption for these individuals would help them to stay in their

homes and their neighborhoods. Keeping seniors in the homes

they’ve lived in for decades is especially valuable, as it contributes

to continuity and stability in the community.”

A

“Yes”

Vote supports amending the state constitution to increase the property tax exemption from $10,000 to

$60,000 of the market value for homesteads owned by elderly or disabled individuals.

A

“No”

Vote opposes amending the state constitution to increase the property tax exemption from $10,000 to

$60,000 of the market value for homesteads owned by elderly or disabled individuals.

Texas Policy Research

Taxpayer Cost: $ 2.7 B

(2026

–

2030) See Fiscal Note @ TLO

“While compassionate in intent, this measure shifts the tax

burden onto younger and non-exempt Texans, expands state

spending commitments without reform, and erodes tax

equity. True relief should come through comprehensive

reform

—

not piecemeal exemptions that weaken limited

government and fiscal discipline.” –

Texas Policy Research

Bill Number: SJR27

Proposition 12

Ba

llo

t

W

or

ding

The constitutional amendment regarding the membership of the State Commission on Judicial Conduct, the membership of the

tribunal to review the commission's recommendations, and the authority of the commission, the tribunal, and the Texas Supreme

Court to more effectively sanction judges and justices for judicial misconduct.

EXPLANATORY STATEMENT

LEGISLATIVE CONTEXT

Author:

Huffman

Chamber Votes:

House [ D / R ] Senate [ D / R ]

YES

119

[ 32/87 ]

27

[ 7/20]

NO

17

[ 17/0 ]

4

[ 4/0]

NV

14

[13/1 ]

0

[ 0/0 ]

Support

BACKGROUND

Texas Legislature

Online Reference

100.0%

65.0%

R

D

The Texas State Commission on Judicial Conduct (SCJC) was created with the approval of Proposition

8 in 1965. Proposition 8 established the commission in the state constitution and provided for

mandatory retirement ages for judges and justices. It was approved with 72.6% of the vote. The SCJC

is governed by Article V, Section 1-a of the Texas Constitution, Chapter 33 of the Texas Government

Code, the Texas Procedural Rules for the State Commission on Judicial Conduct, and the Texas Code

of Judicial Conduct. The constitution defines judicial misconduct as the “willful or persistent violation

of rules promulgated by the Supreme Court of Texas, incompetence in performing the duties of the

office, willful violation of the Code of Judicial Conduct, or willful or persistent conduct that is clearly

inconsistent with the proper performance of [the judge’s] duties or casts public discredit upon the

judiciary or administration of justice.” The commission considers all alleged misconduct complaints

made by individuals, reported by a news article, or obtained through an investigation. The SCJC is

composed of: six judges from the appellate, district, county court at law, constitutional county, justice

of the peace, and municipal court levels, two attorneys appointed by the state bar who are not judges,

and five citizen members appointed by the governor who are not attorneys or judges. During fiscal

year 2024, the SCJC received 1,135 complaints. At the time of the annual report, 49 had resulted in

disciplinary action, and 258 cases were still pending.

TEXAS CONSTITUTION IMPACT(S)

Article(s): 5

Add section(s):

Delete section(s):

Amend section(s): 1(a)

Full Resolution

Text

CONSTITUTIONAL HISTORY

The State Commission on Judicial Conduct was established in the state constitution with the approval

of Proposition 8 in 1965. Since then, Texas voters have approved six amendments to the section,

making changes to the commission composition and authority. All amendments were approved with

at least 59% of the vote.

© 2025

36

SJR 27 proposes a constitutional amendment to change the membership and procedures of the State

Commission on Judicial Conduct (SCJC). The proposed amendment would: (1) change the

membership of the SCJC so that it is composed of six judges appointed by the Texas Supreme Court

and seven citizens appointed by the Governor who are at least 35 years old, with both groups of

appointees requiring the consent of the Texas Senate to be confirmed; (2) restrict the SCJC’s power

to issue a private reprimand (or impose a requirement that the person obtain additional training or

education) to a person who has not previously been issued a private reprimand and in response to a

complaint that does not allege criminal behavior; (3) require the SCJC to find that a person engaged in